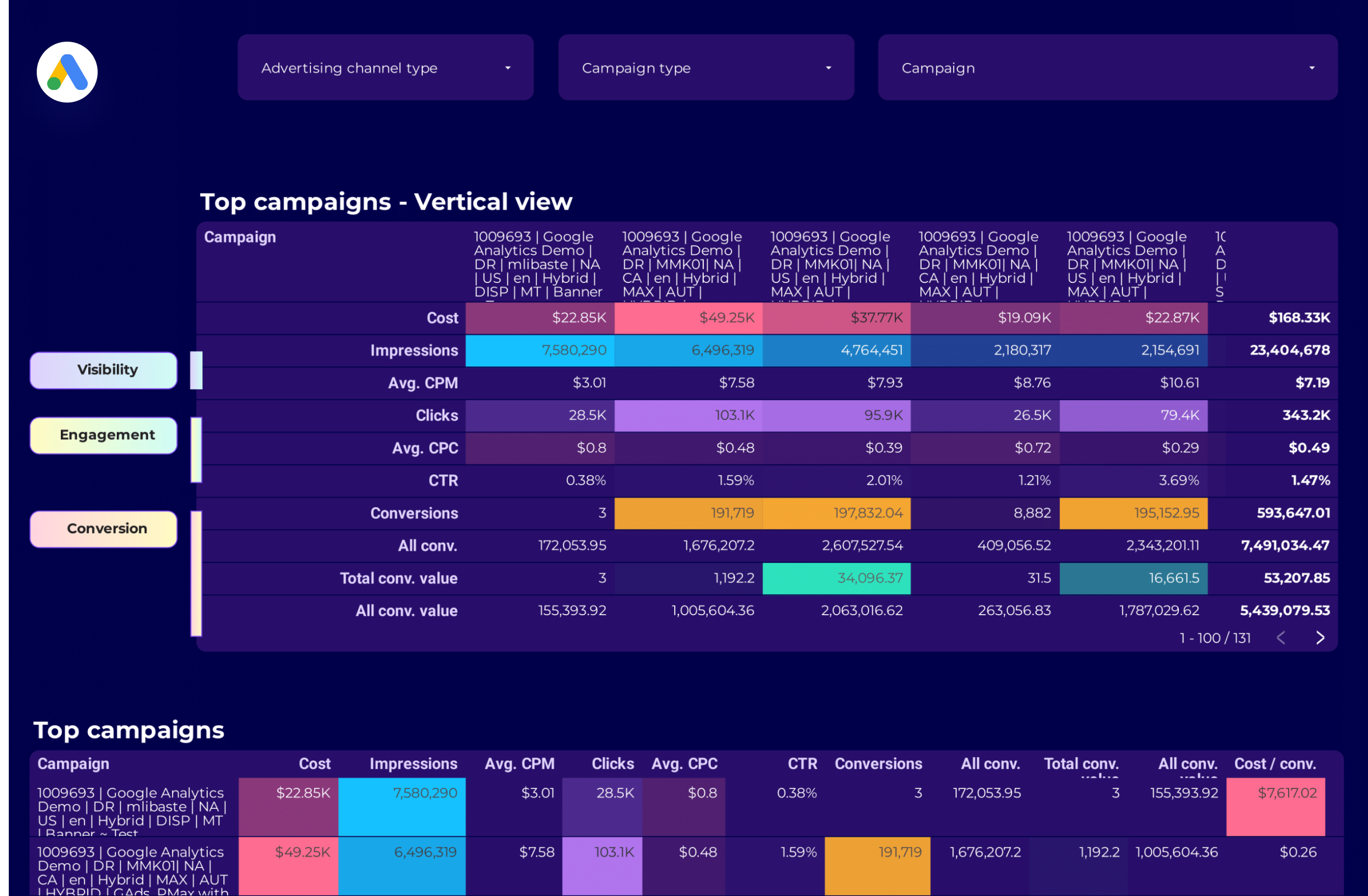

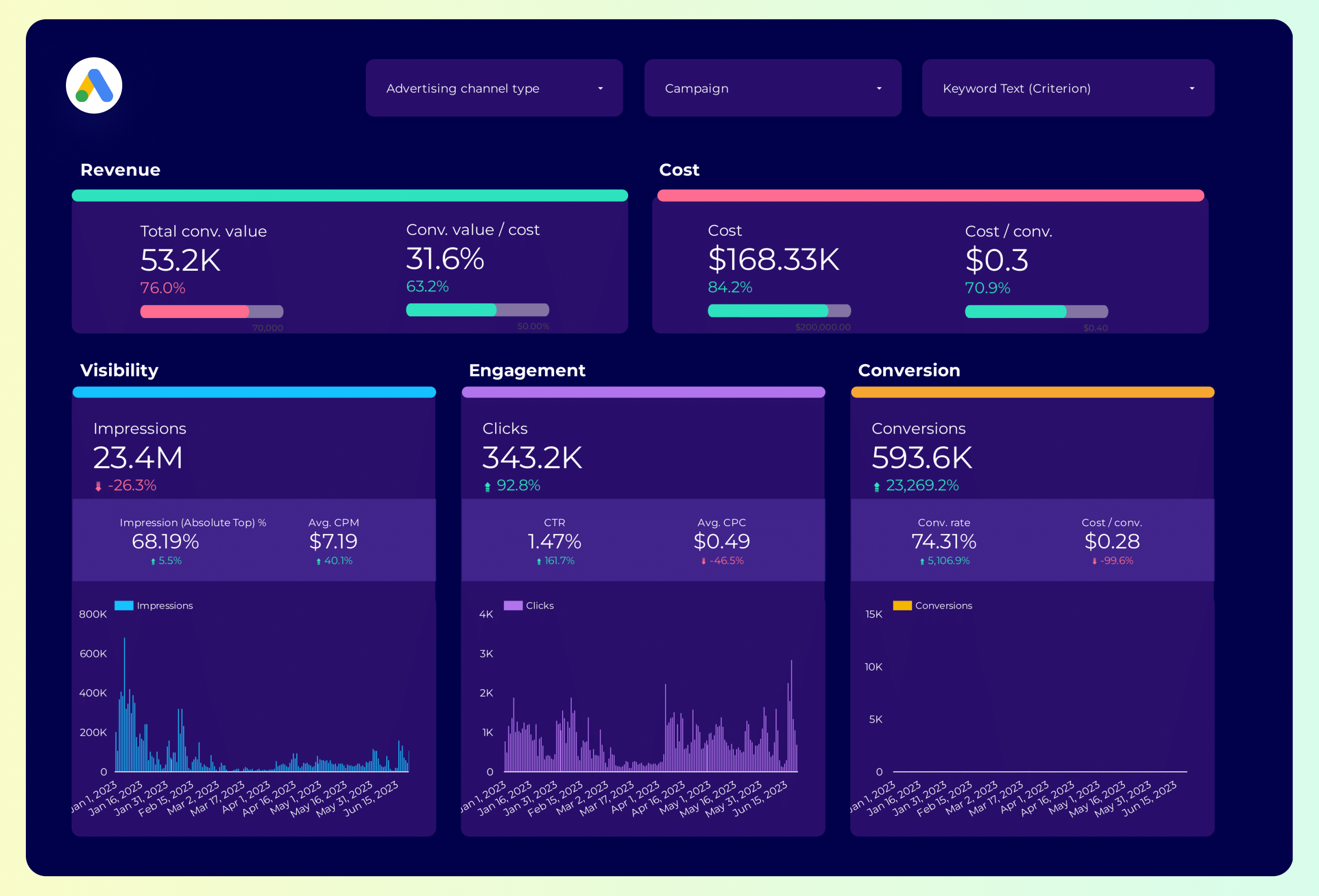

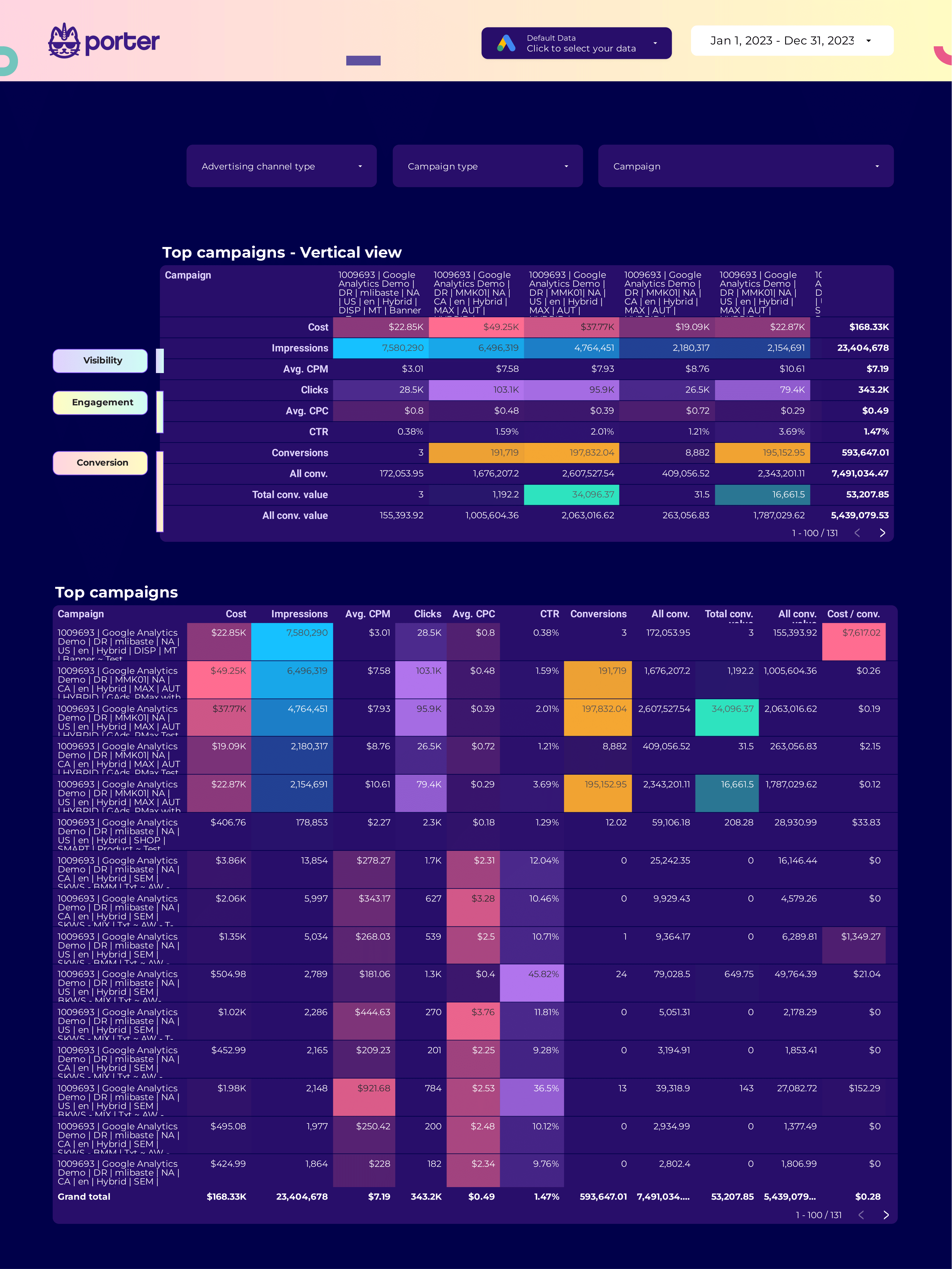

Google Ads Campaign performance Report template for Marketing teams and agencies

Analyze key metrics like conversion rate, CTR, and impressions with this Google Ads Campaign performance report template. Segment by campaign type, audience, and time. Ideal for PPC specialists to track performance and refine paid media strategies. Consolidate data from Google Ads for actionable insights and strategic marketing goals.

Google Ads Report template for Marketing teams and agencies

Optimize your PPC strategy with this Google Ads report template. Track conversion rate, cost per conversion, and CTR. Analyze by campaign type, audience, and time. Perfect for marketing teams to measure performance and align with objectives. Consolidate data from Google Ads and Paid Media for actionable insights and enhanced campaign management.

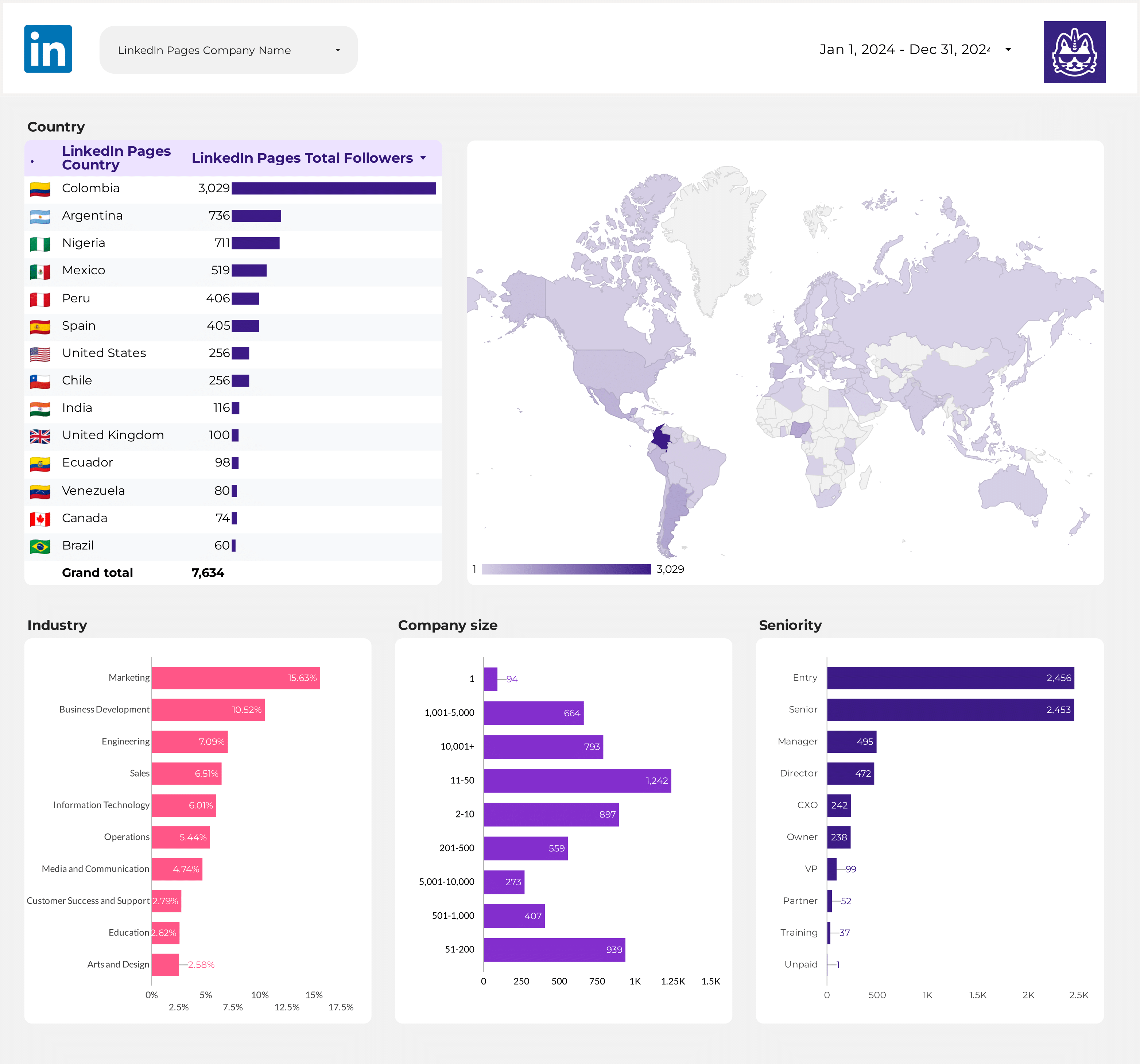

LinkedIn Pages Report template for Marketing teams and agencies

Optimize your LinkedIn Pages strategy with this report template. Track CTR, conversion rate, and engagement. Analyze metrics by audience, objectives, and channels. Measure performance across demographics and timeframes. Perfect for marketing teams to refine strategies and achieve LinkedIn goals.

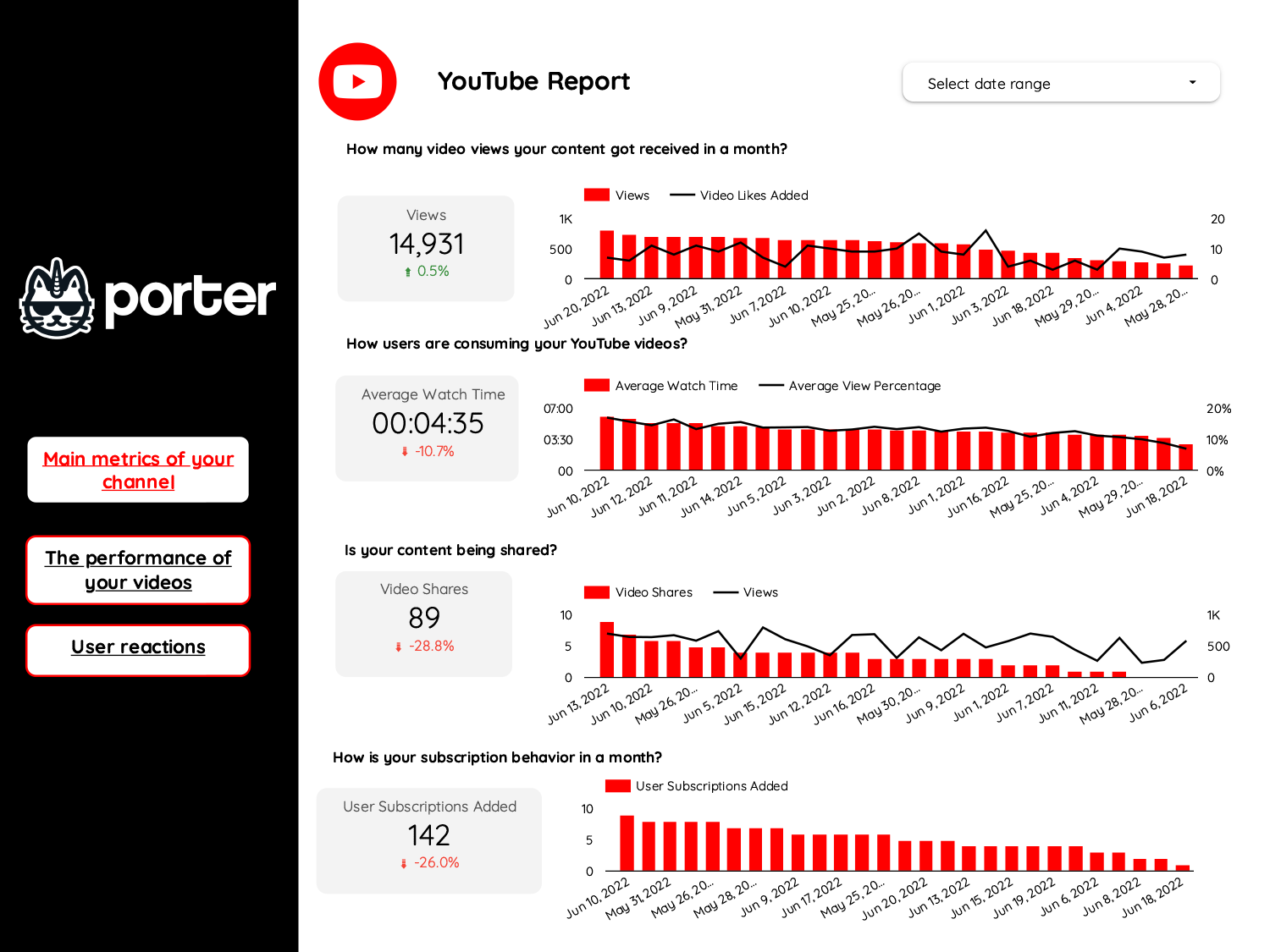

Youtube Report template for Marketing teams and agencies

Optimize your social media strategy with this Youtube report template. Track CTR, conversion rate, CPA, likes, comments, shares, views, watch time, and subscribers. Analyze by audience, age, gender, interests, and time. Perfect for marketing teams seeking actionable insights to enhance performance across advertising platforms and align with SEO objectives.

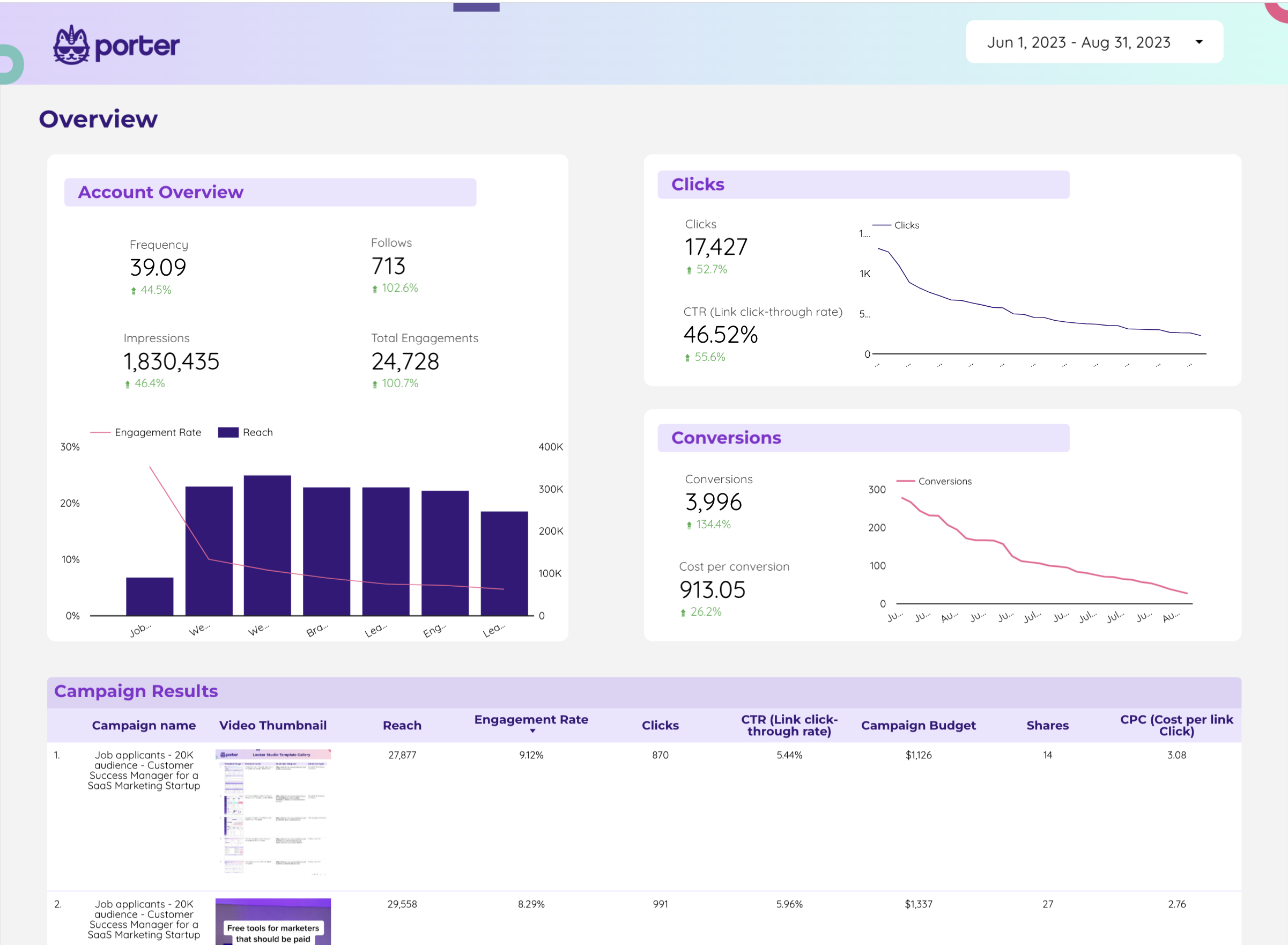

Twitter Ads Report template for Marketing teams and agencies

Analyze key metrics like CTR, conversion rate, and social actions with this Twitter Ads report template. Track performance by campaign objective, ad format, and audience targeting. Segment data by time, location, gender, and age. Perfect for PPC specialists to consolidate Twitter Ads and Paid Media strategies for actionable insights.

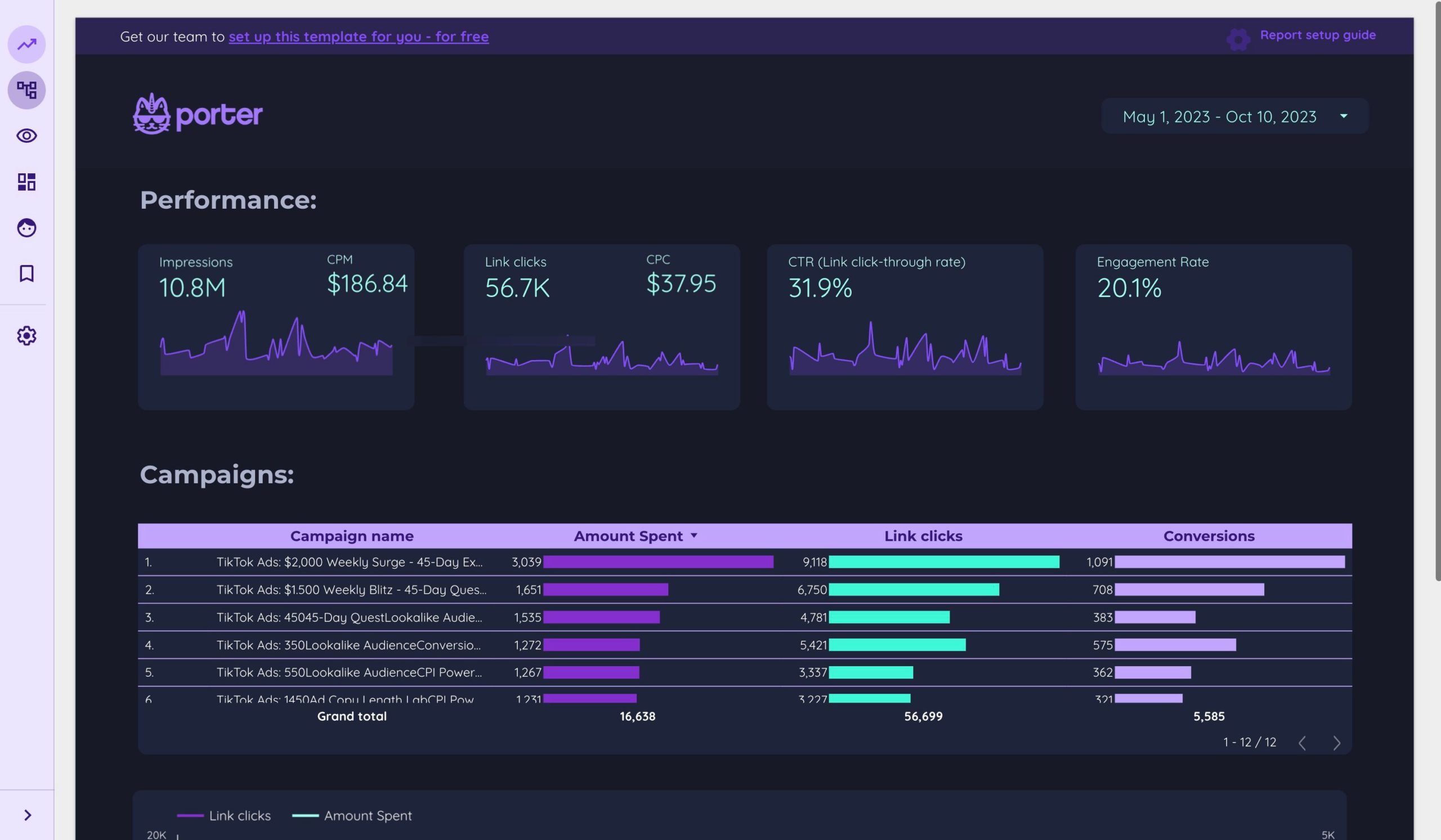

TikTok Ads Report template for Marketing teams and agencies

Optimize TikTok Ads performance with this report template. Track CTR, conversion rate, and cost per conversion. Analyze impressions, reach, and engagement. Segment by audience, ad placement, and time. Perfect for PPC specialists aiming to achieve marketing goals and enhance strategy.

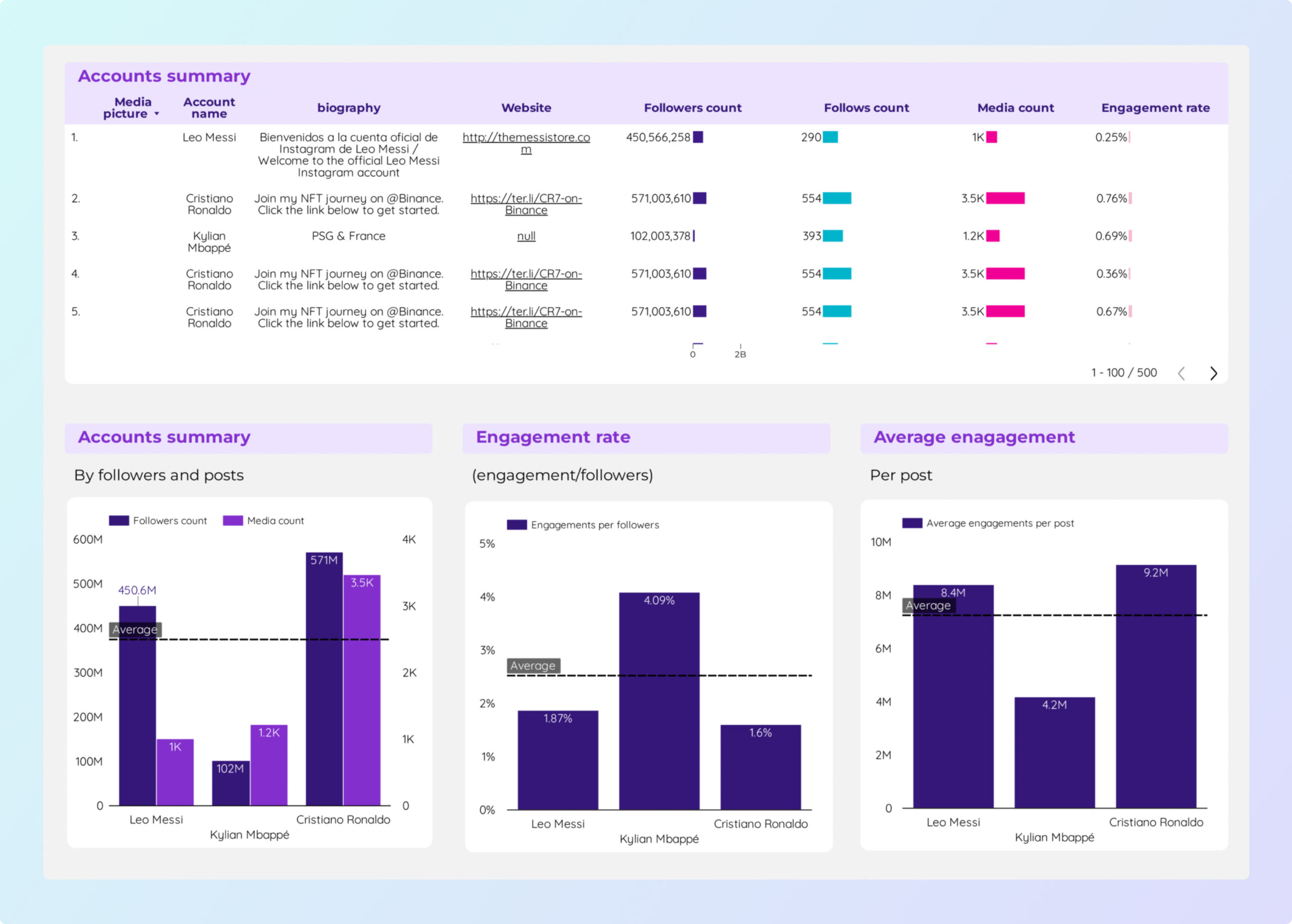

Social Media competitors Report template for Marketing teams and agencies

Analyze key metrics such as CTR, conversion rate, and engagement with the Social Media competitors report template. Utilize data from Social Media and Instagram Public Data. Segment by audience demographics, content strategy, and timeframes. Perfect for marketing teams to assess performance and optimize strategies.

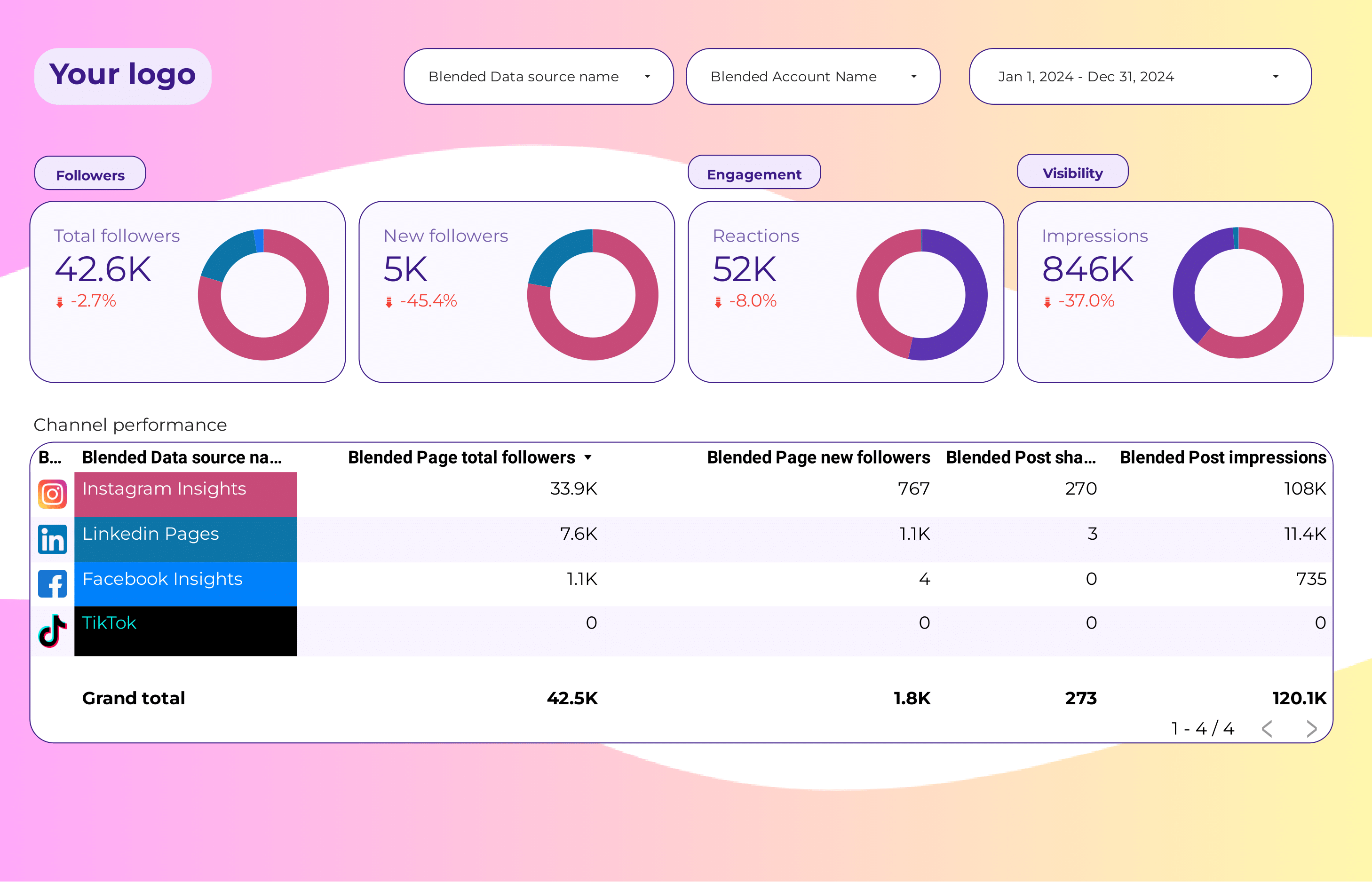

Social Media Report template for Marketing teams and agencies

Optimize your strategy with this Social Media report template. Analyze conversion rates, ROAS, and engagement metrics from Instagram Insights and LinkedIn Pages. Track key metrics like likes, comments, and shares. Segment by audience, age, and location. Perfect for marketing teams to measure performance and achieve specific goals.

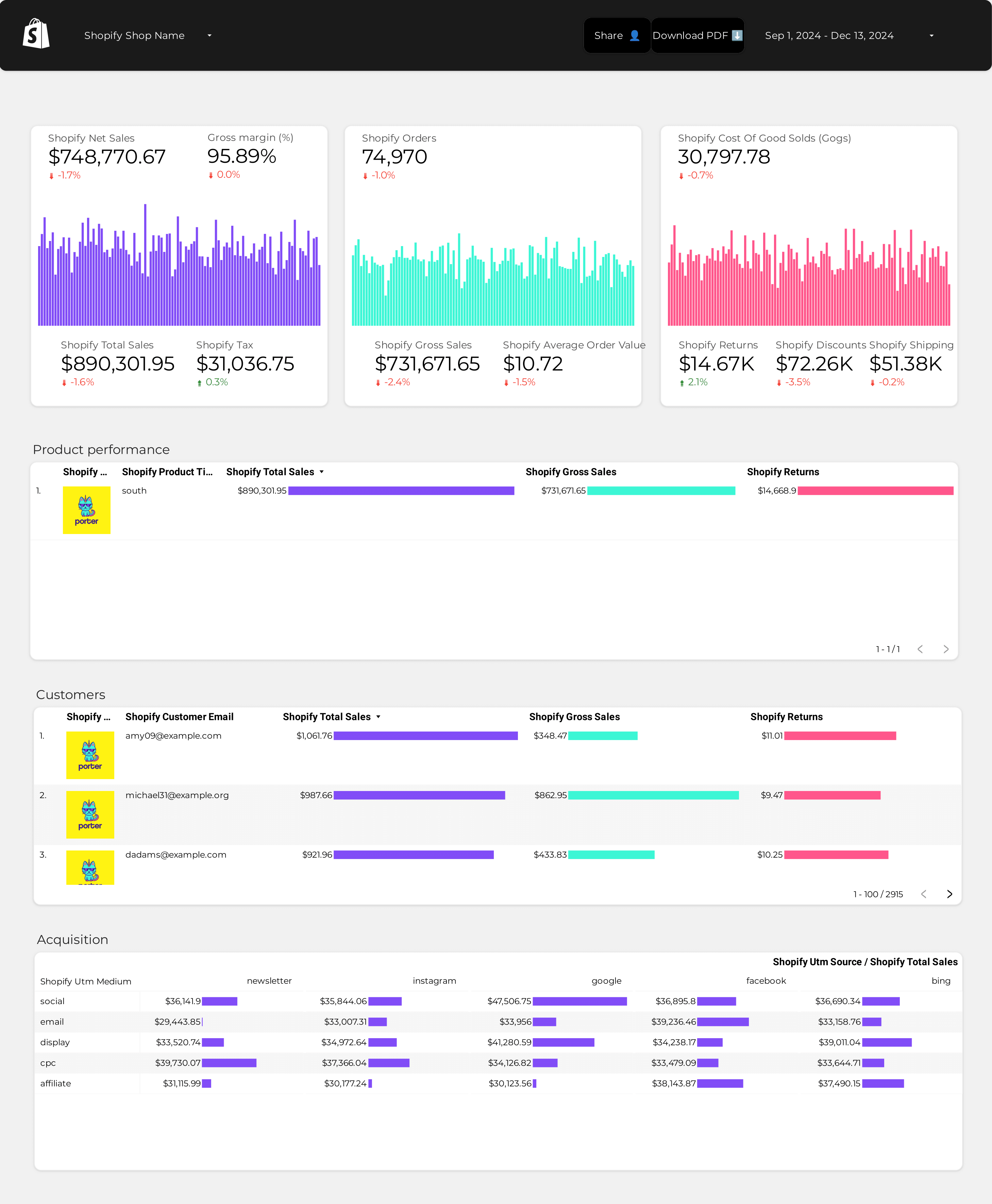

Shopify Report template for Marketing teams and agencies

Analyze key metrics like revenue, average order value, and conversion rate with this Shopify report template. Track cost per acquisition and return on ad spend. Segment by audience, messaging, and channels. Ideal for e-commerce marketing teams to unify insights and optimize strategies. Perfect for monitoring Shopify store performance across various timeframes.

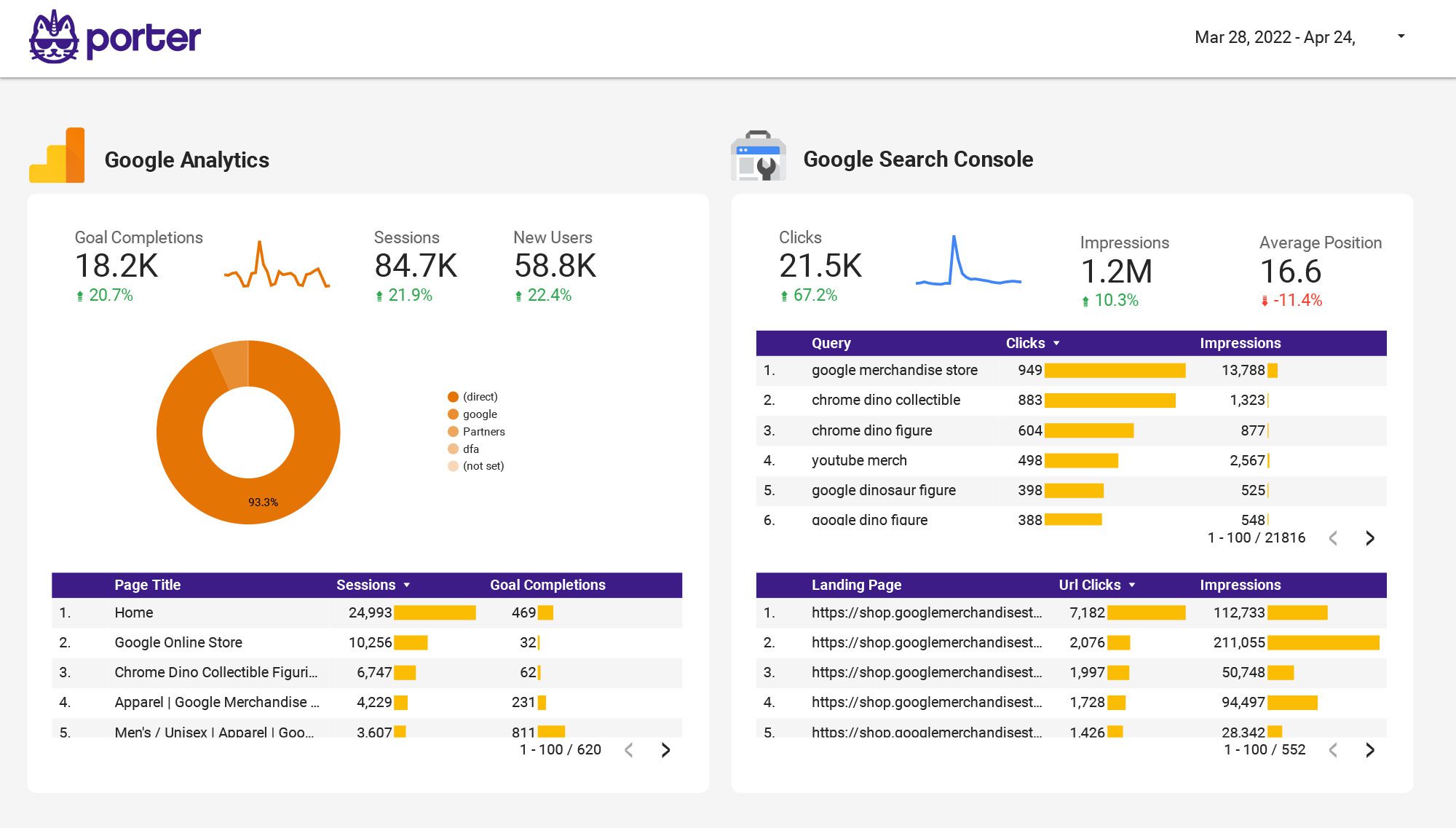

SEM Report template for Marketing teams and agencies

Optimize your SEM strategy with this report template. Analyze cost per conversion, conversion rate, and ROAS. Measure click-through rate, social media engagement, and organic search ranking. Segment by audience, content, platform, and more. Perfect for PPC specialists to track Google Ads and Paid Media performance.

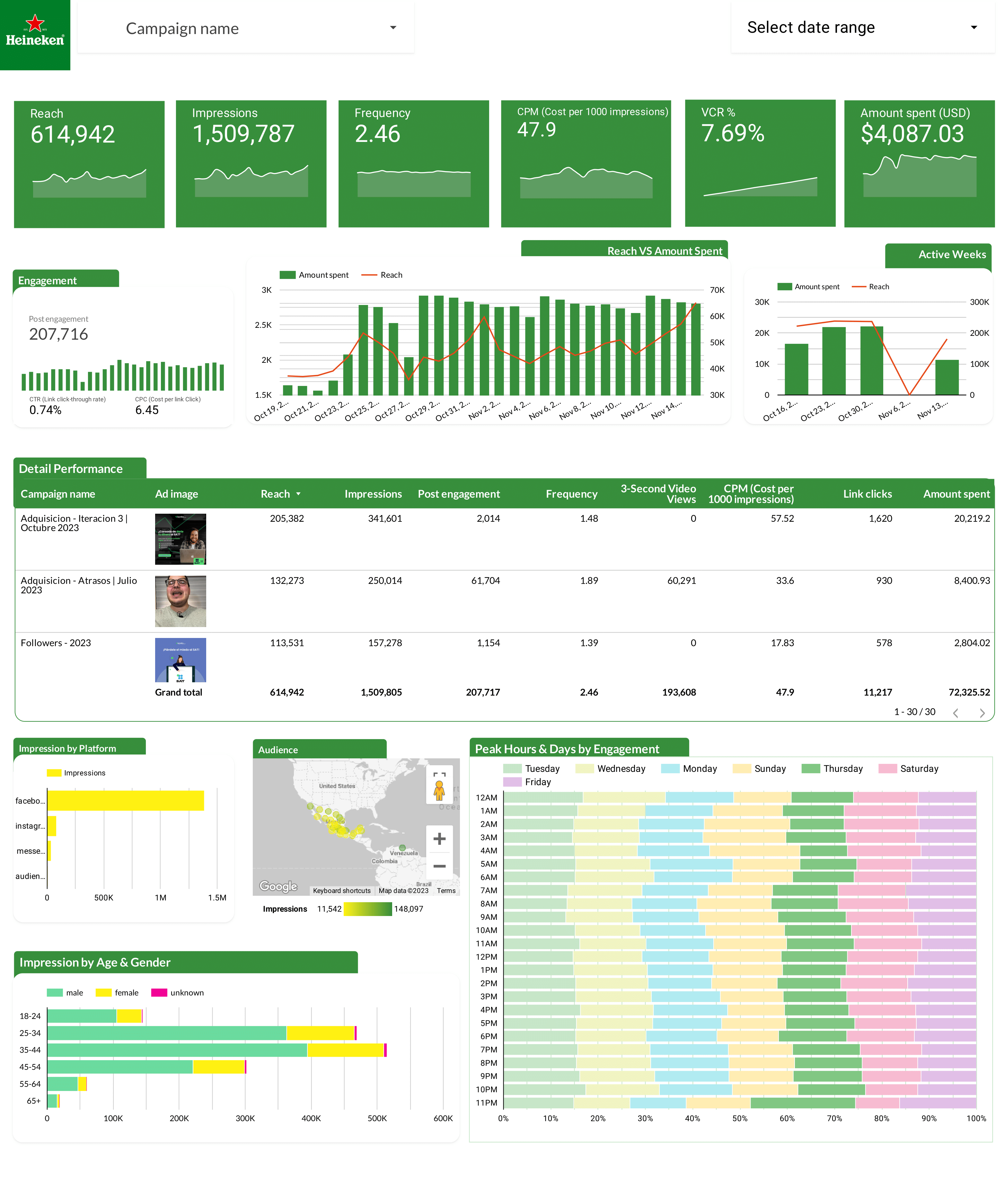

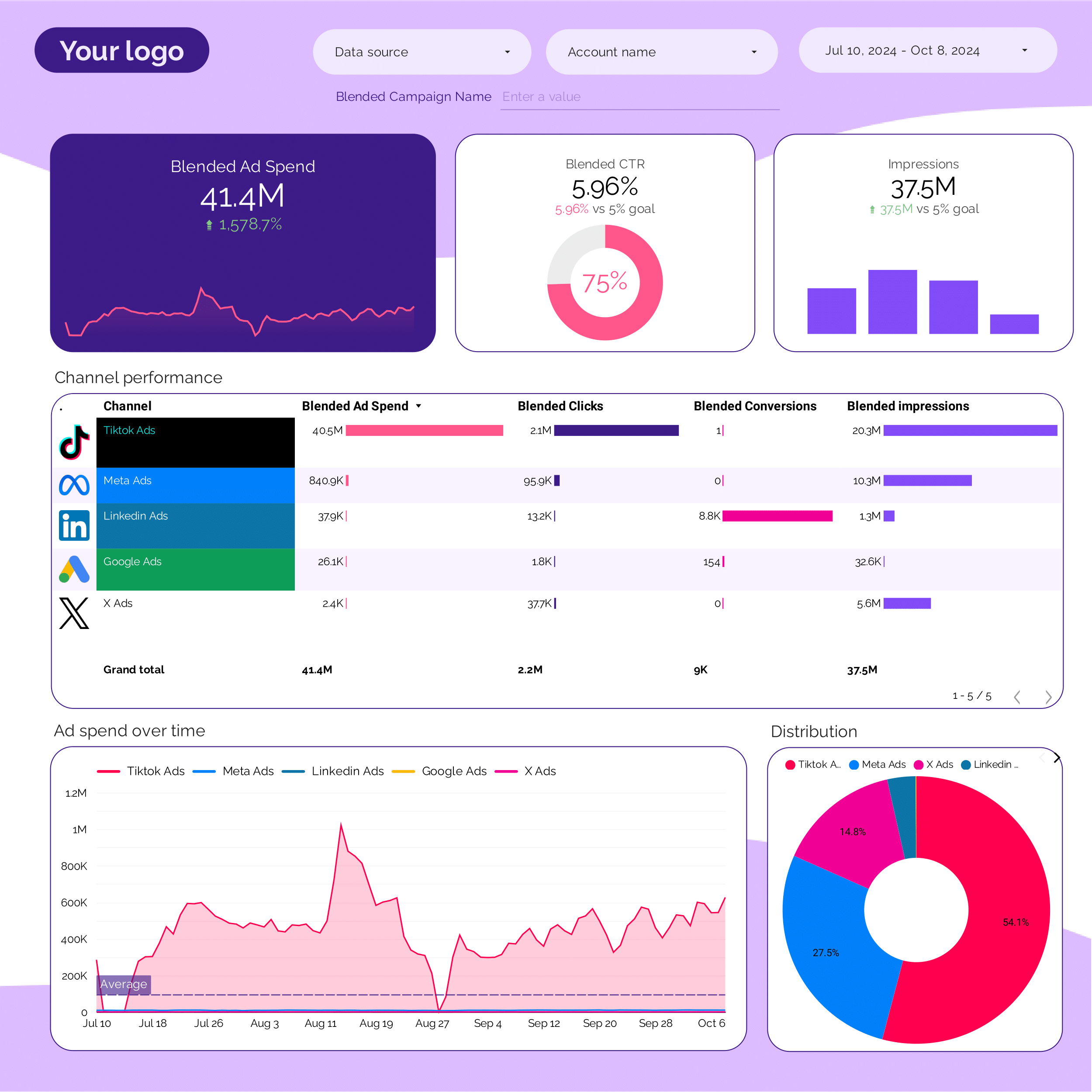

Paid media Report template for Marketing teams and agencies

Analyze key metrics like CTR, conversion rate, and CPA with this Paid media report template. Integrate data from Facebook Ads, TikTok Ads, Google Ads, and more. Segment by location, age, and interests. Ideal for PPC specialists to track performance and refine strategies across platforms using Google Analytics 4.

Multi-channel Marketing performance Report template for Marketing teams and agencies

Optimize your strategy with the Multi-channel Marketing performance report template. Track CTR, ROI, and engagement metrics from SEO, Google Analytics 4, Facebook Ads, Instagram Insights, and more. Analyze channel performance and customer engagement by demographics and timeframes. Perfect for marketing teams to measure and improve performance across diverse platforms.

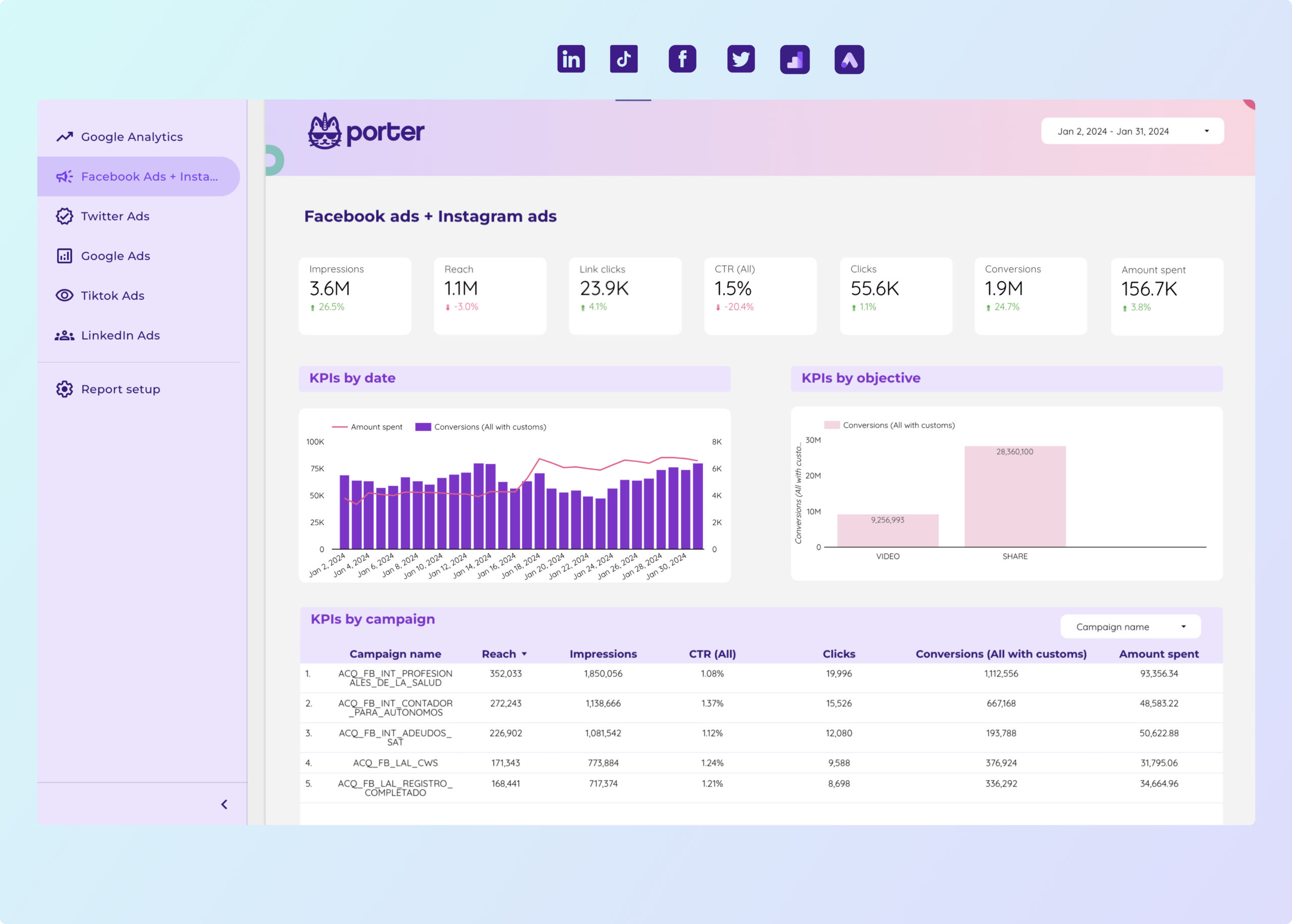

Facebook Ads Report template for Marketing teams and agencies

Optimize your Facebook Ads strategy with this report template. Measure key metrics like cost per conversion, ROAS, and CTR. Analyze performance by audience, placement, and time. Ideal for PPC specialists to track and improve paid media campaigns. Consolidate data from Facebook Ads and PPC for actionable insights.

Local SEO Report template for Marketing teams and agencies

Optimize your local SEO strategy with this Local SEO report template. Track CTR, conversion rate, and cost per conversion. Analyze keyword ranking, organic traffic, and local pack visibility. Segment data by demographics, location, and behavior over time. Perfect for marketing teams aiming to achieve specific goals and improve performance.

Lead generation Report template for Marketing teams and agencies

Optimize your strategy with the Lead generation report template. Track conversion rates, cost per conversion, and ROI. Analyze B2B, CRM, Email Marketing, and Facebook Ads data. Segment by audience, demographics, and behavior. Measure SQLs, sales cycle length, and CRM contact performance. Ideal for marketing teams seeking actionable insights.

PPC monthly Report template for Marketing teams and agencies

Get the actual PPC monthly on Looker Studio template used by Porter to monitor PPC performance.

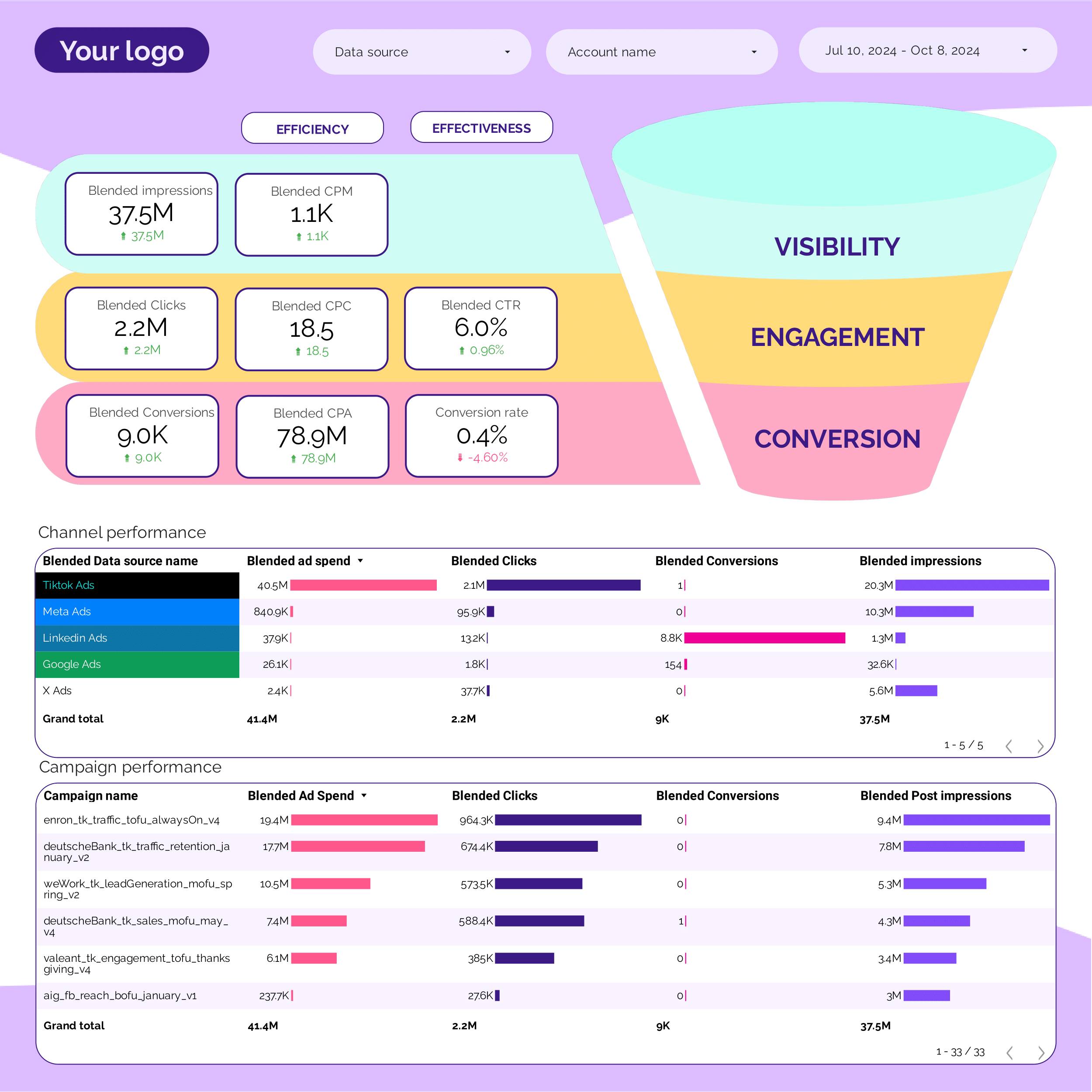

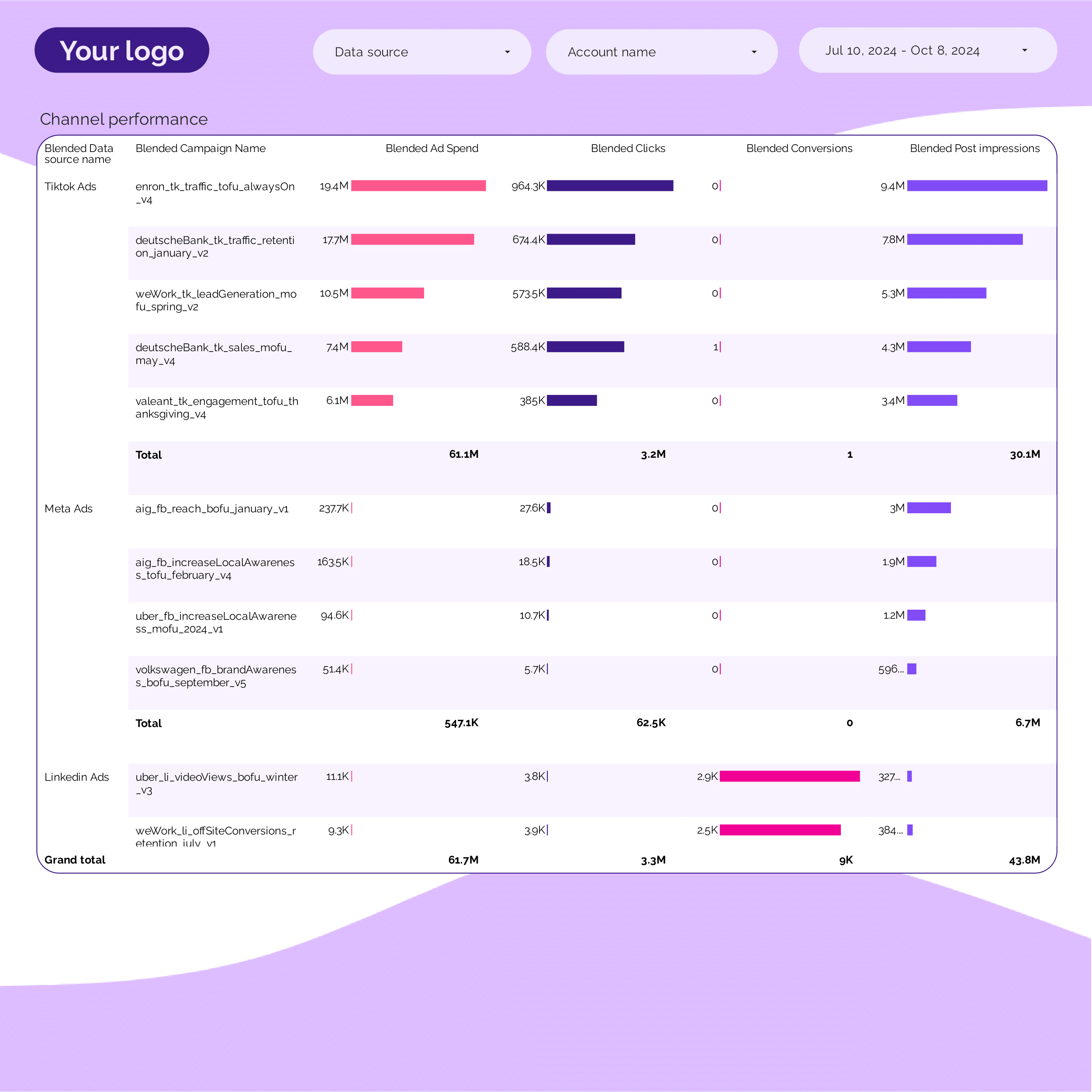

PPC multi-channel Report template for Marketing teams and agencies

Get the actual PPC multi-channel on Looker Studio template used by Porter to monitor PPC performance.

PPC KPIs Report template for Marketing teams and agencies

Get the actual PPC KPIs on Looker Studio template used by Porter to monitor PPC performance.

PPC Funnel Report template for Marketing teams and agencies

Get the actual PPC Funnel on Looker Studio template used by Porter to monitor PPC performance.

PPC Campaign performance Report template for Marketing teams and agencies

Get the actual PPC Campaign performance on Looker Studio template used by Porter to monitor PPC performance.

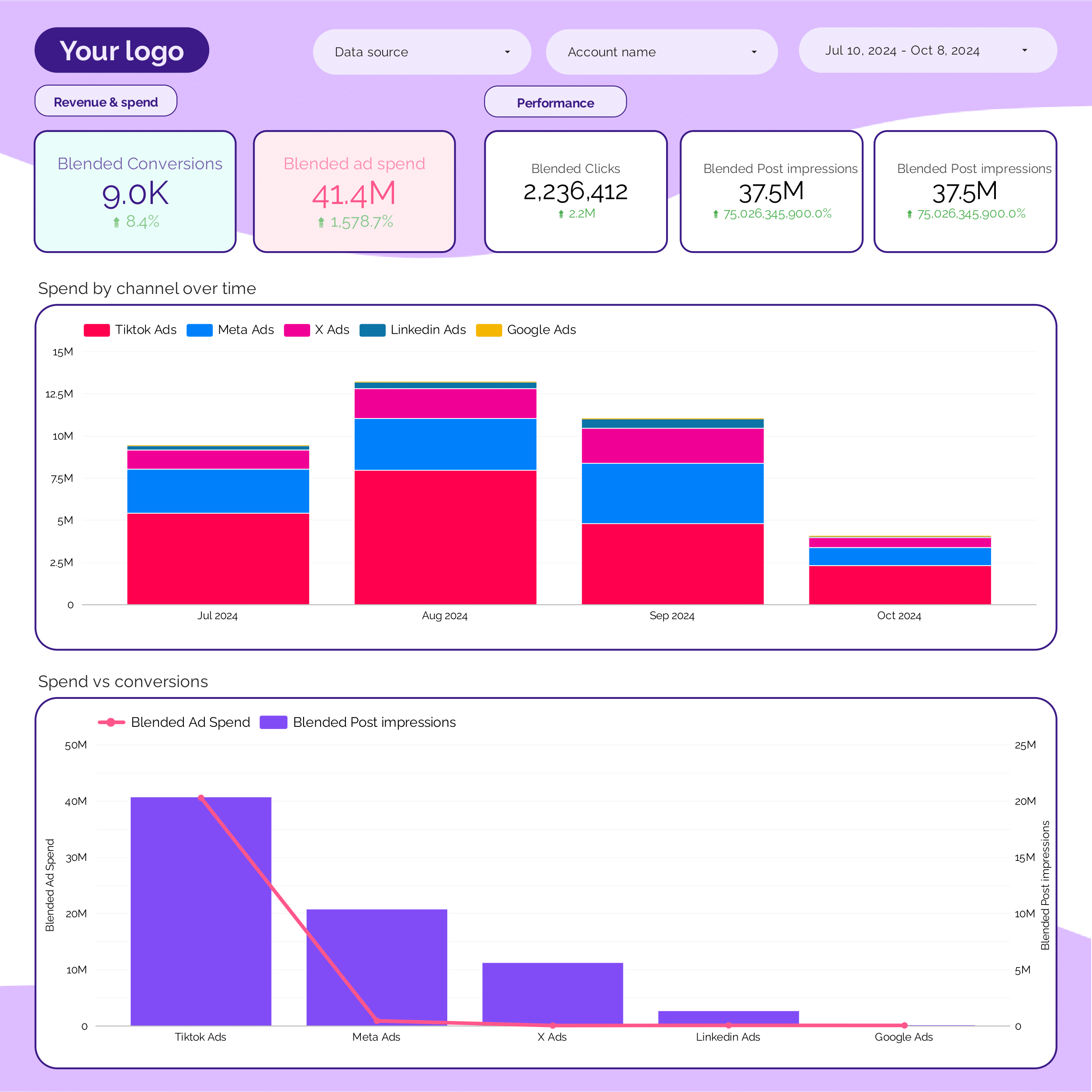

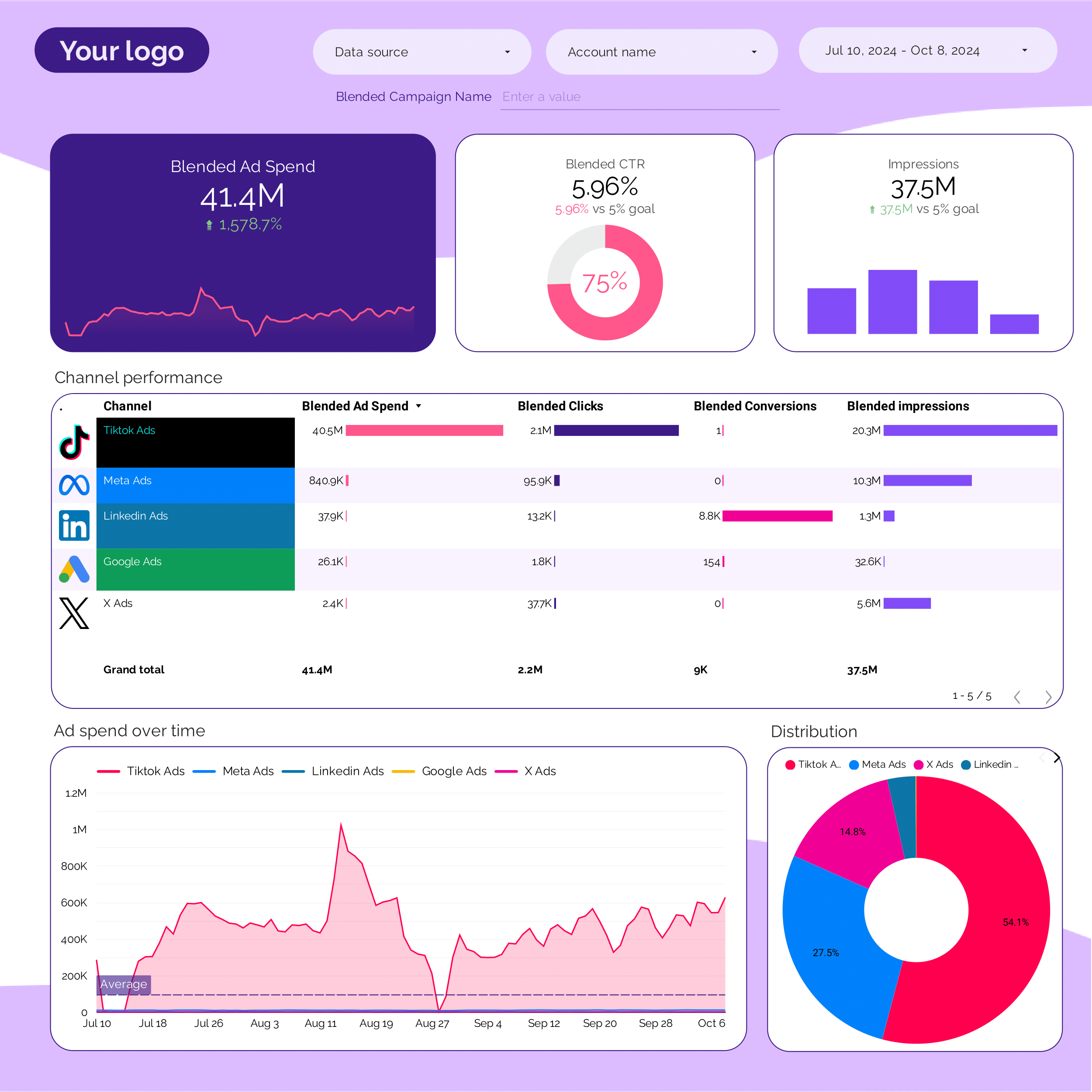

PPC Report template for Marketing teams and agencies

Optimize your PPC strategy with this report template. Track metrics like conversion rate, ROAS, and CTR across Facebook Ads, TikTok Ads, and Google Ads. Analyze by audience, channel, and time. Ideal for marketing teams to measure campaign performance and achieve objectives efficiently.

PPC budget tracking and pacing Report template for Marketing teams and agencies

Get the actual PPC budget tracking and pacing on Looker Studio template used by Porter to monitor PPC performance.

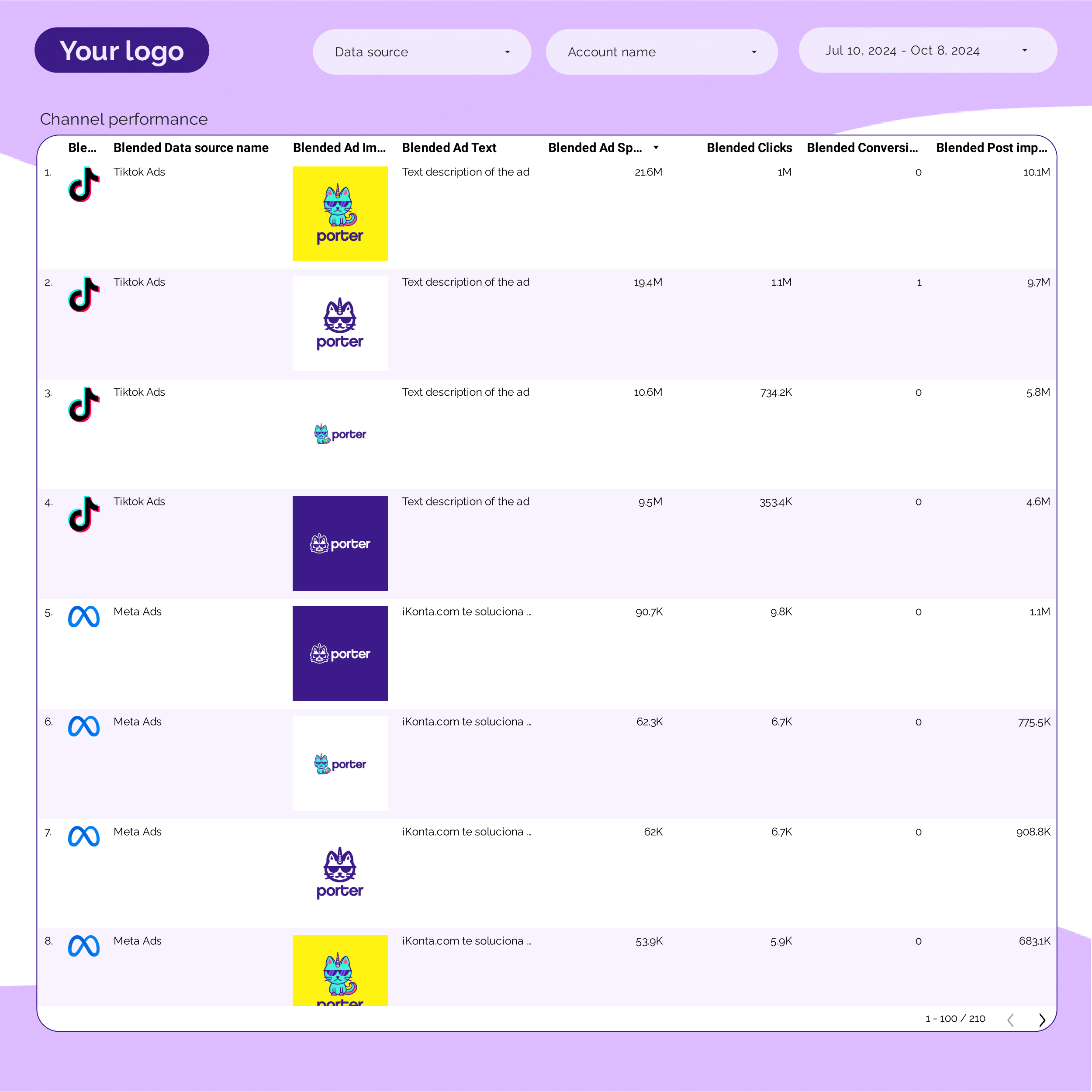

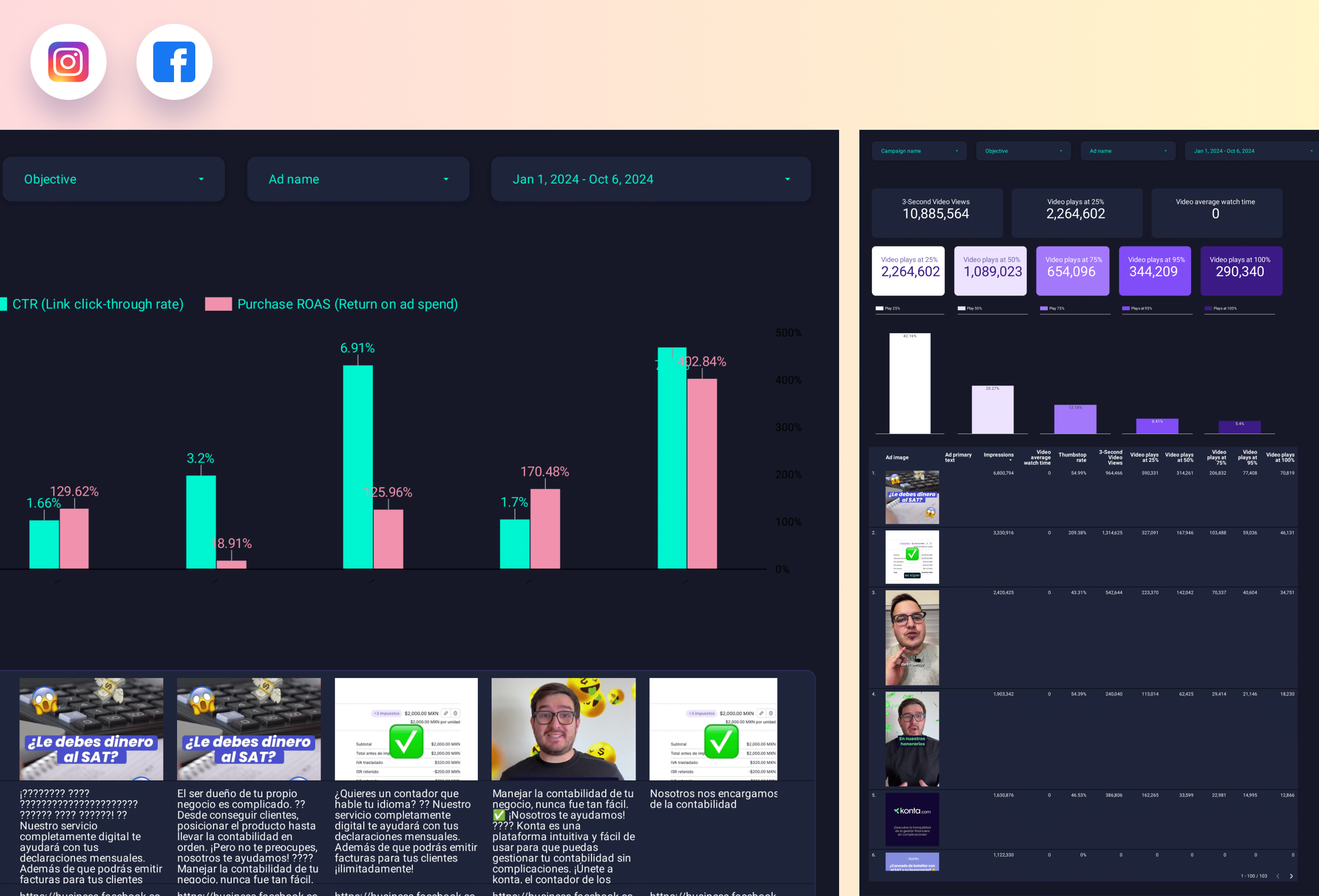

Paid media Creative performance Report template for Marketing teams and agencies

Analyze key metrics with the Paid media Creative performance report template. Measure CTR, CPA, and conversion rates across Facebook, TikTok, and Google Ads. Segment by audience, message, and channel. Track impressions, reach, and engagement. Ideal for marketing teams to refine PPC strategies and meet specific goals.

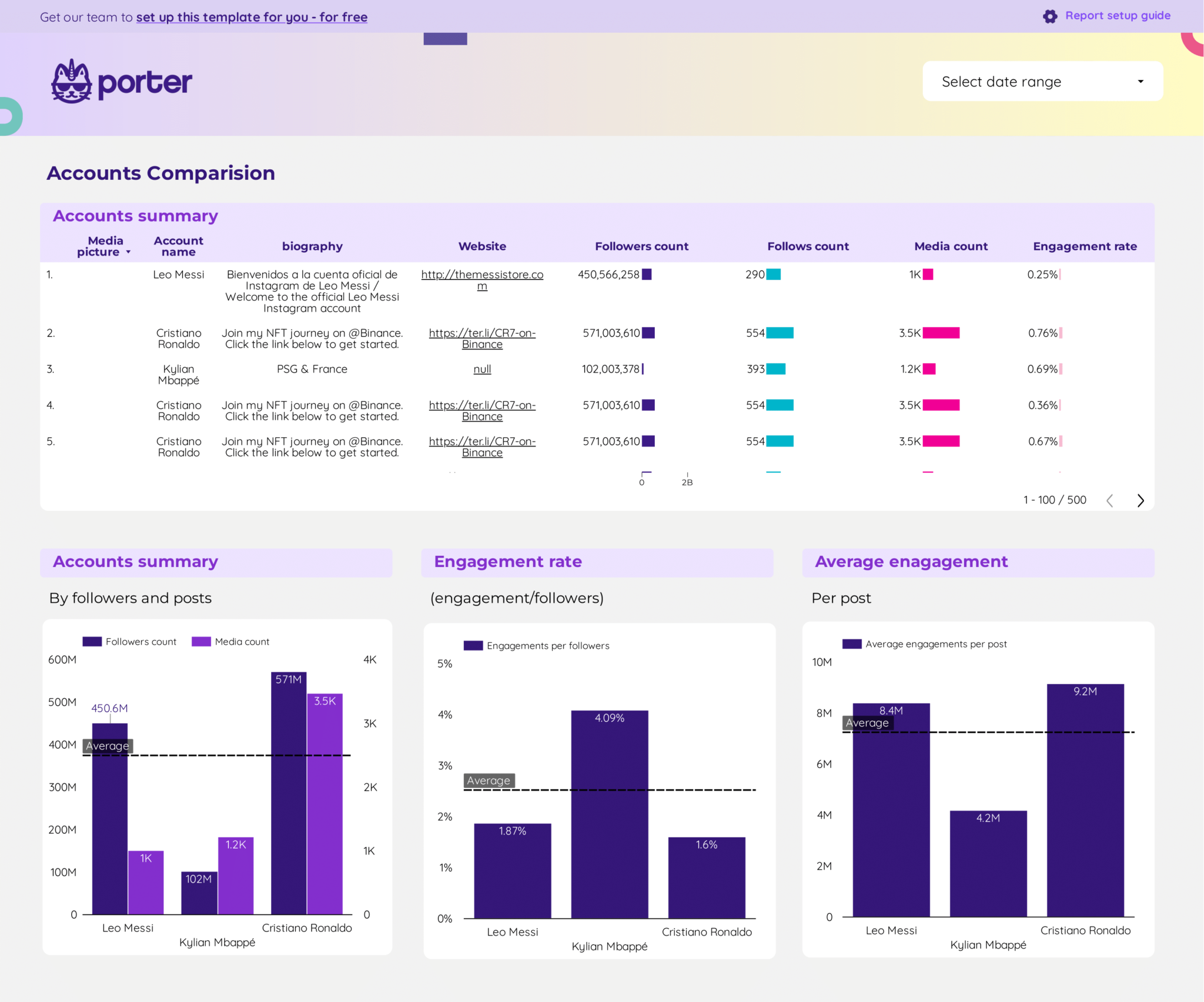

Instagram Insights competitors Report template for Marketing teams and agencies

Optimize your strategy with the Instagram Insights competitors report template. Analyze CTR, conversion rate, CPA, likes, and engagement. Segment by audience, goals, and duration. Leverage social media and Instagram public data for actionable insights. Perfect for marketing teams to track performance across demographics and timeframes.

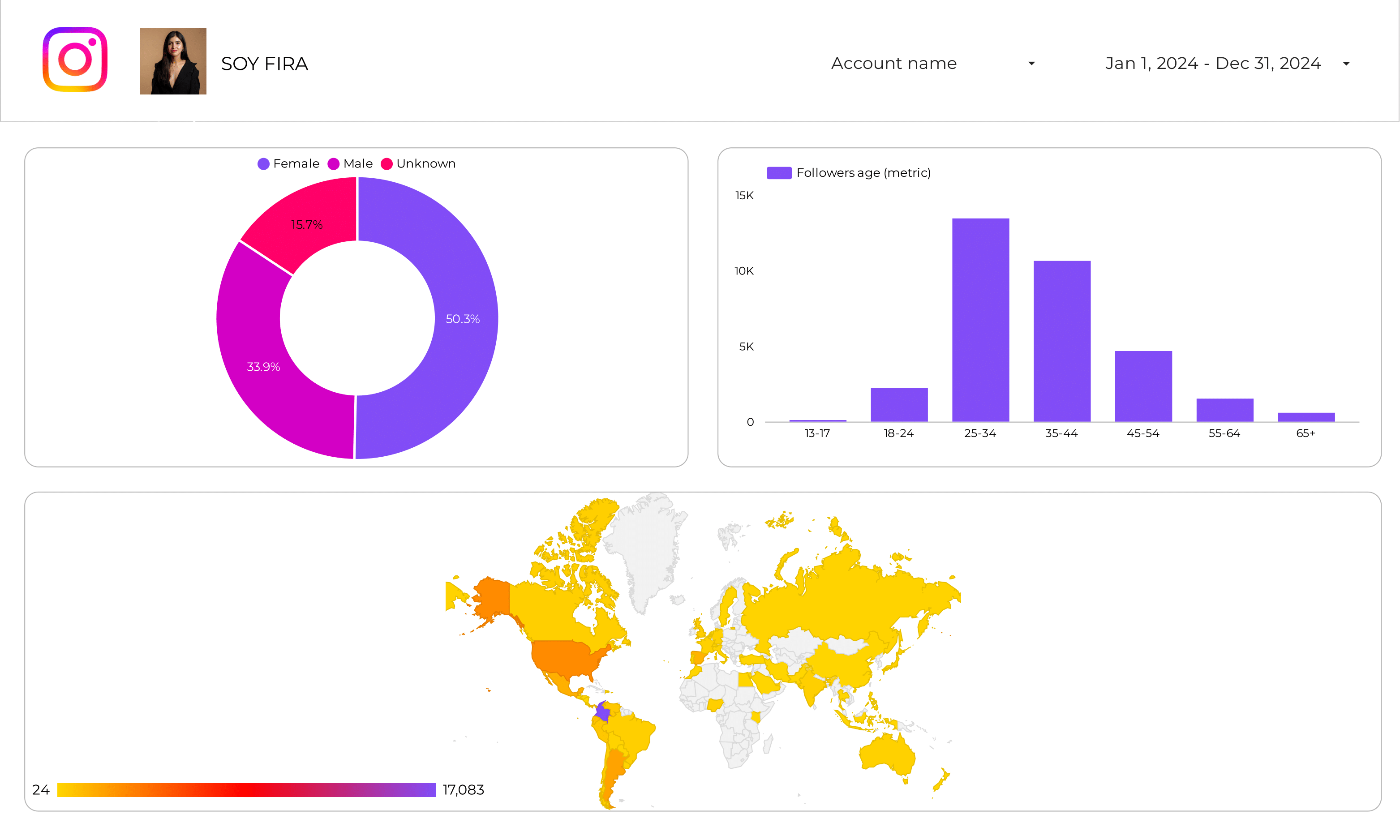

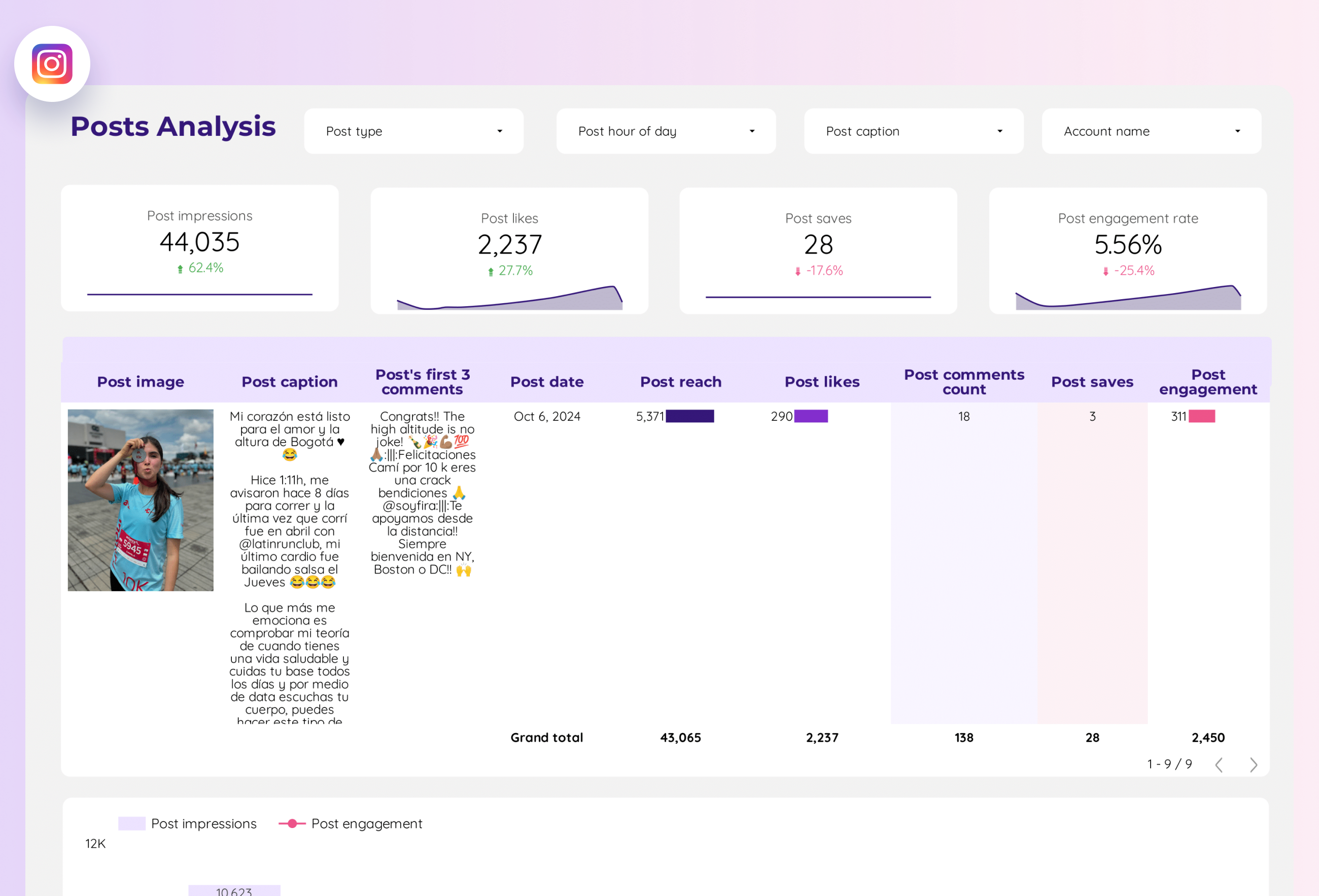

Instagram Insights Report template for Marketing teams and agencies

Analyze key metrics with the Instagram Insights report template. Measure CTR, conversion rate, ROI, likes, comments, shares, impressions, and reach. Segment by age, gender, location, and time. Ideal for social media marketers to consolidate performance data and refine strategies. Gain actionable insights to optimize engagement and ROI.

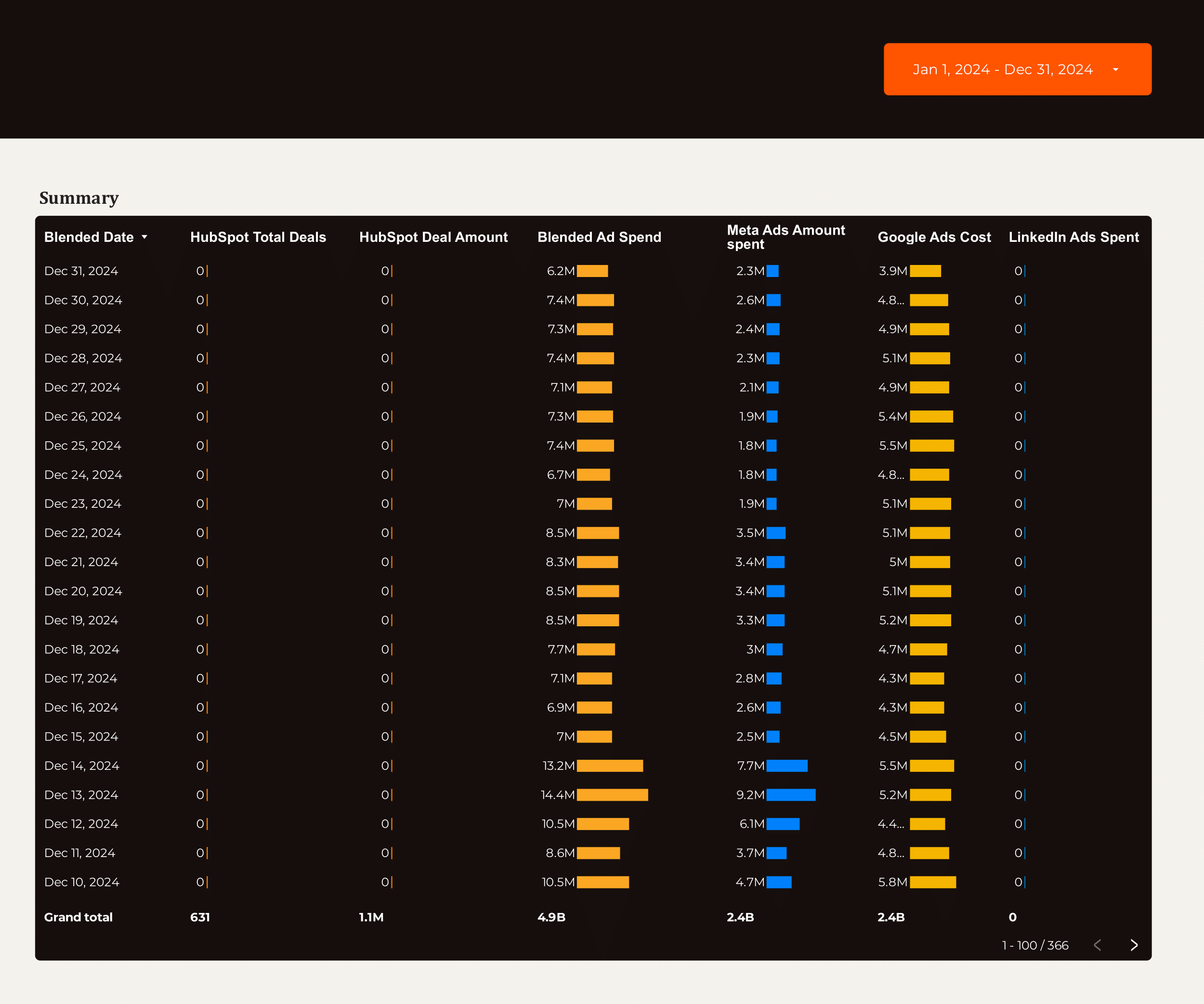

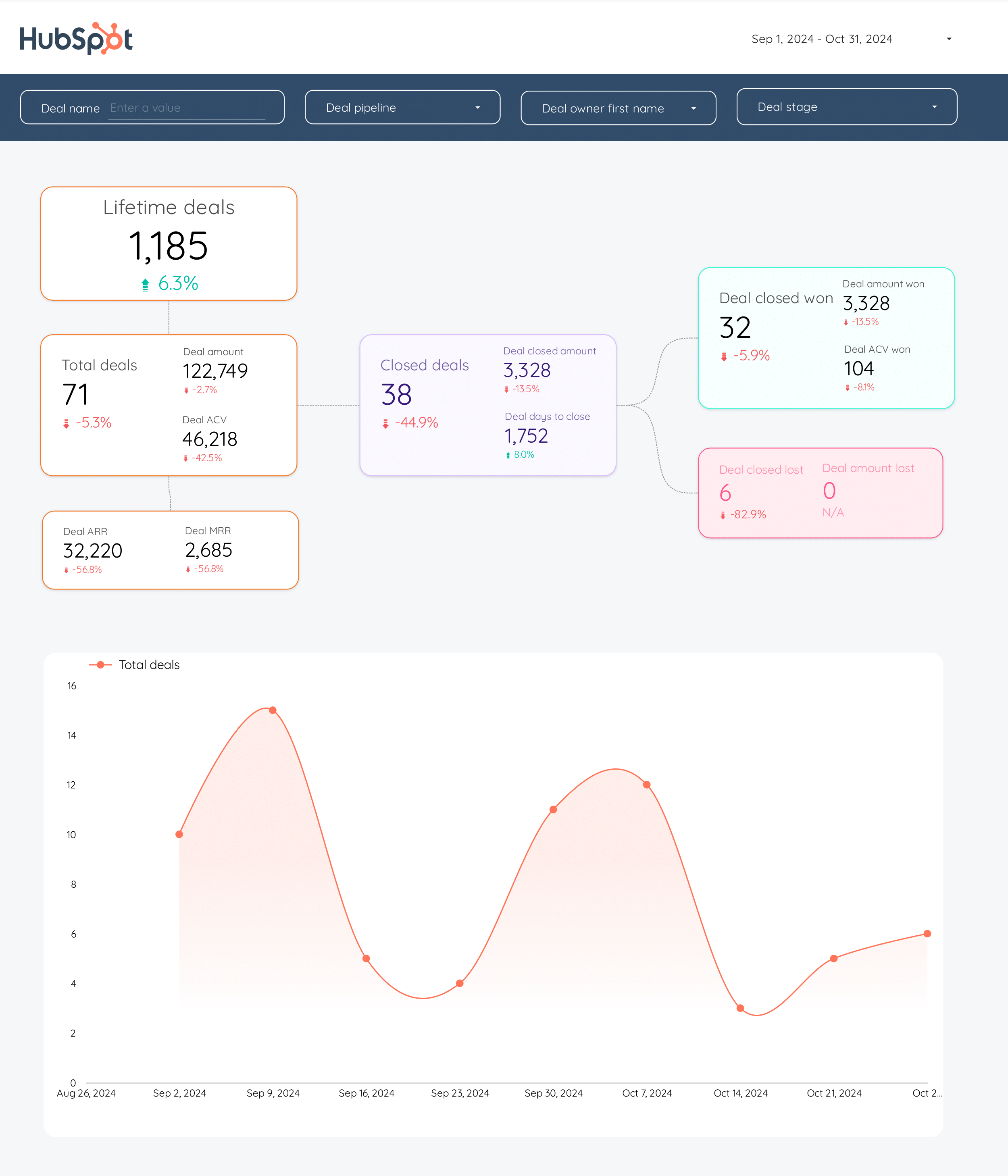

HubSpot Report template for Marketing teams and agencies

Optimize B2B marketing with this HubSpot report template. Track metrics like conversion rate, ROI, and average deal size. Analyze CRM contacts and campaign performance by demographic and psychographic breakdowns. Ideal for inbound marketing teams to measure and refine email marketing and funnel strategies across different timeframes.

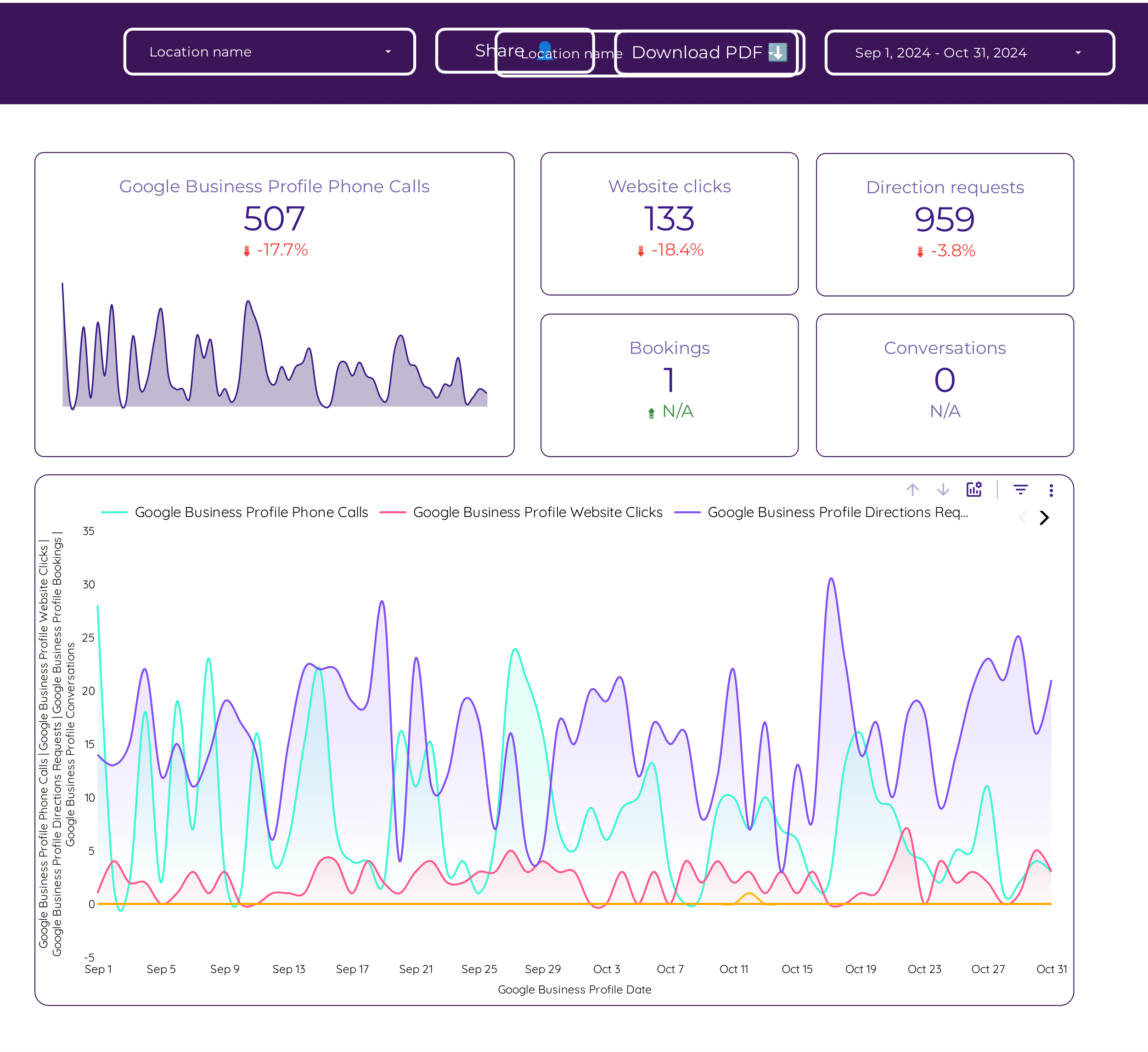

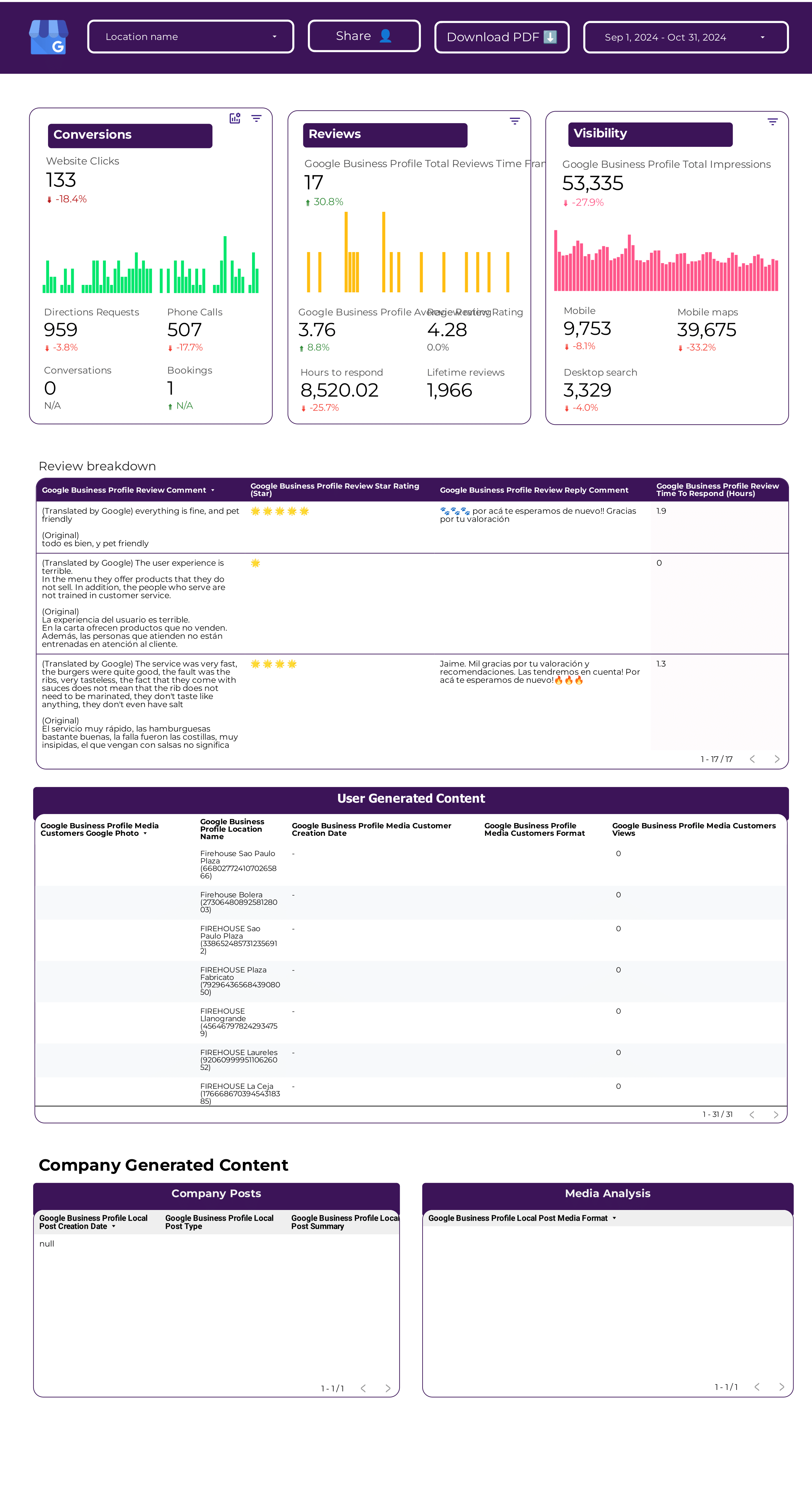

Google Business Profile Report template for Marketing teams and agencies

Optimize your local SEO strategy with this Google Business Profile report template. Track CTR, conversion rate, CAC, clicks, impressions, and reviews. Analyze data by location, age, gender, and time. Perfect for marketing teams aiming to consolidate performance insights and meet specific goals.