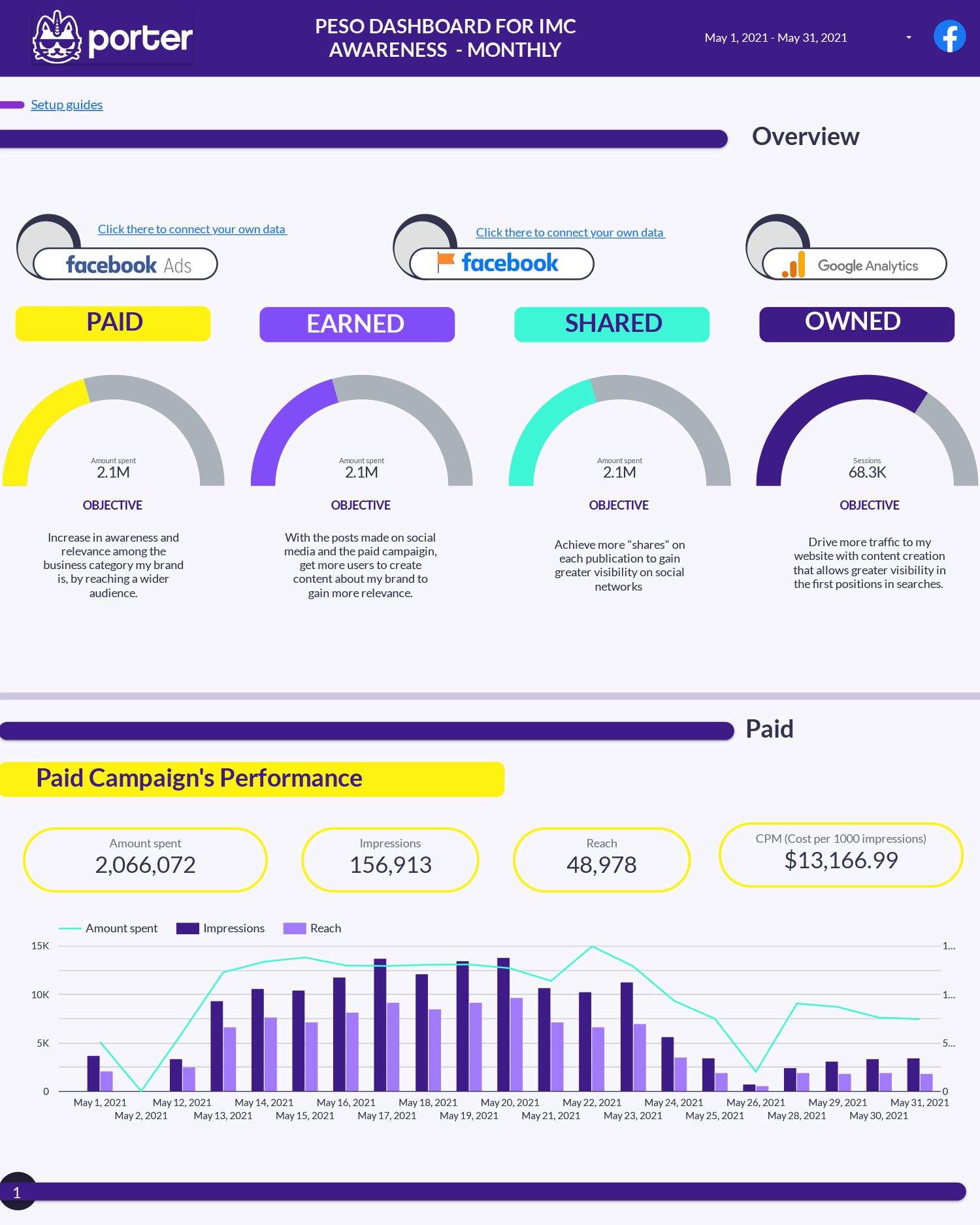

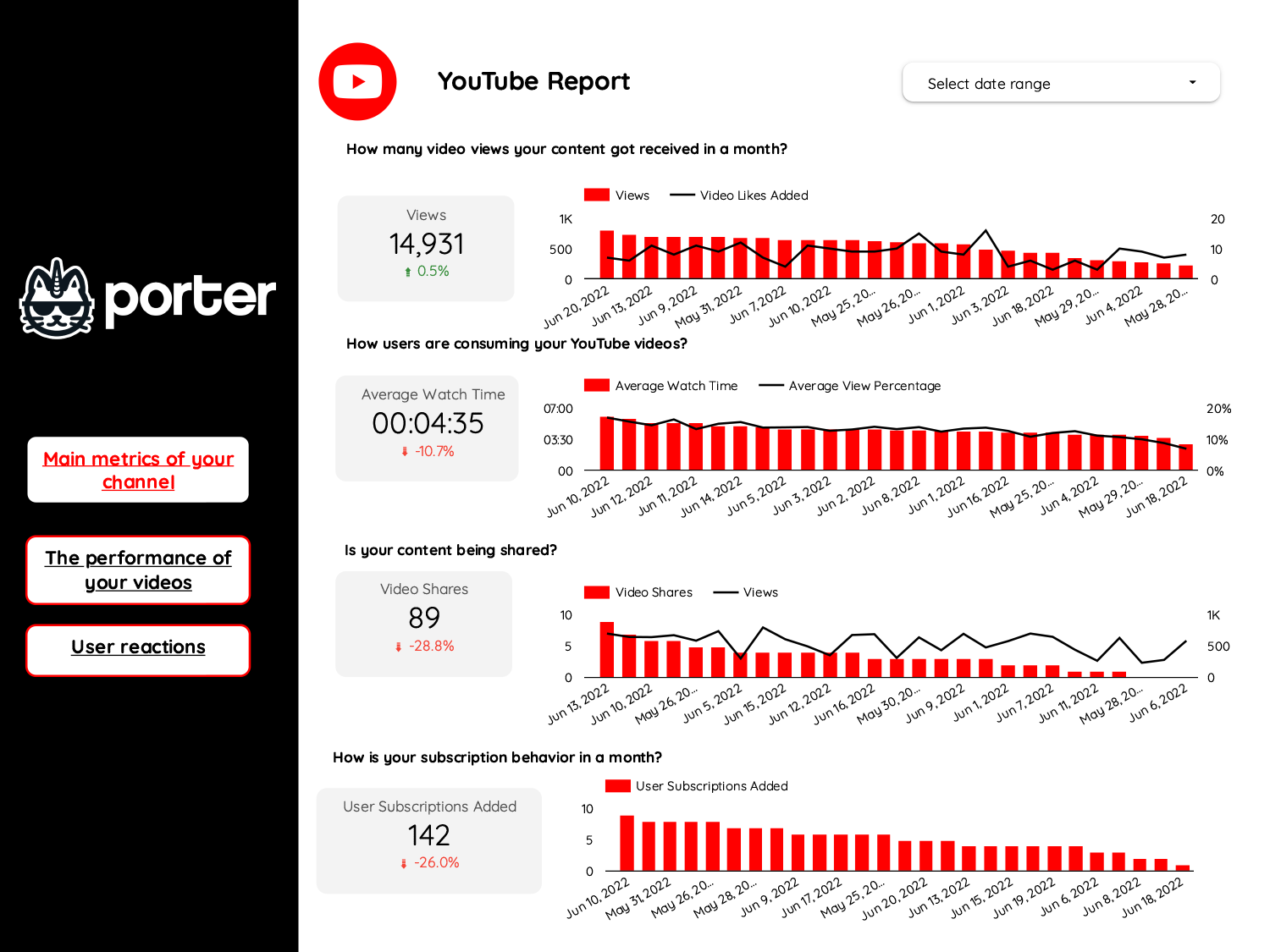

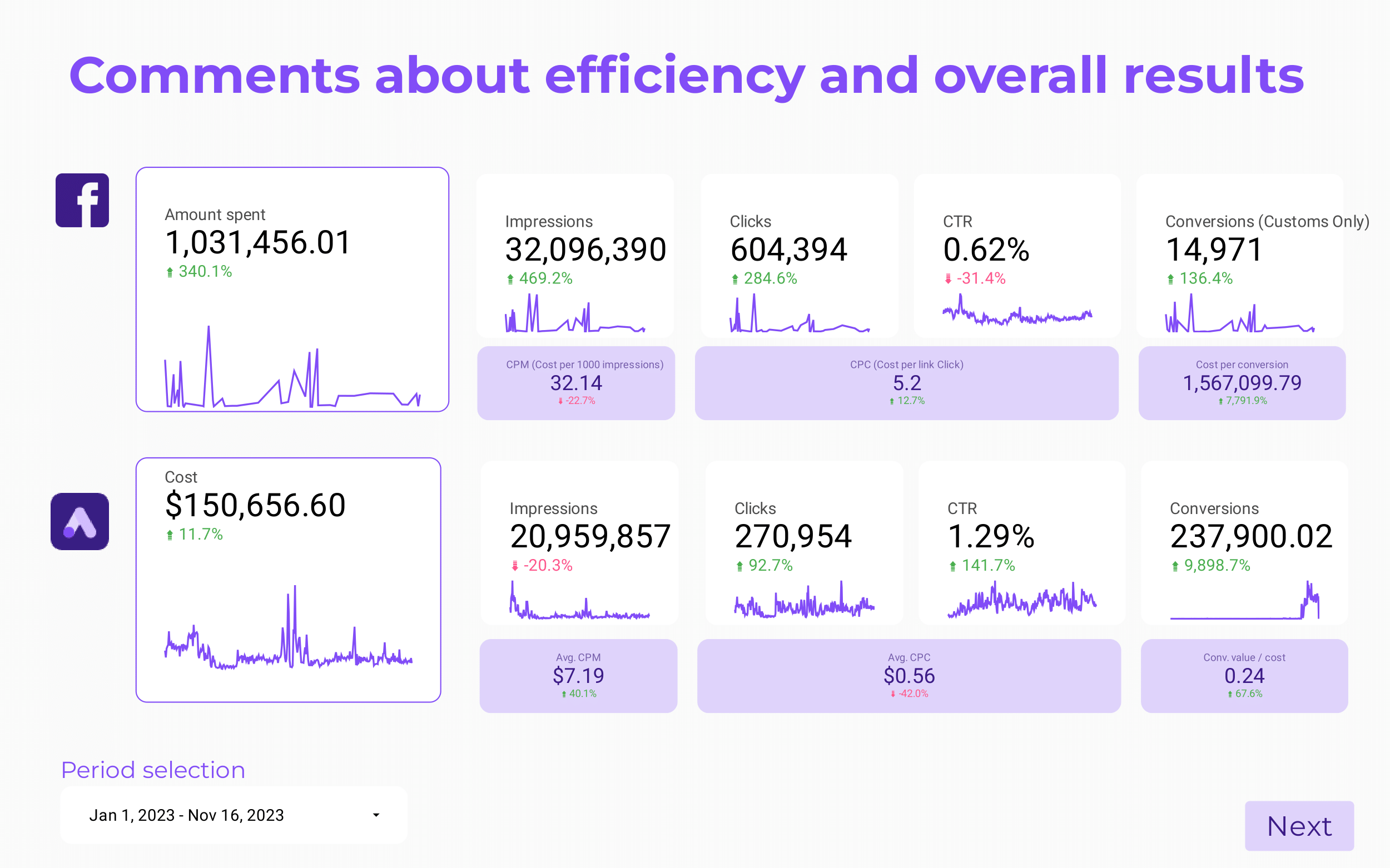

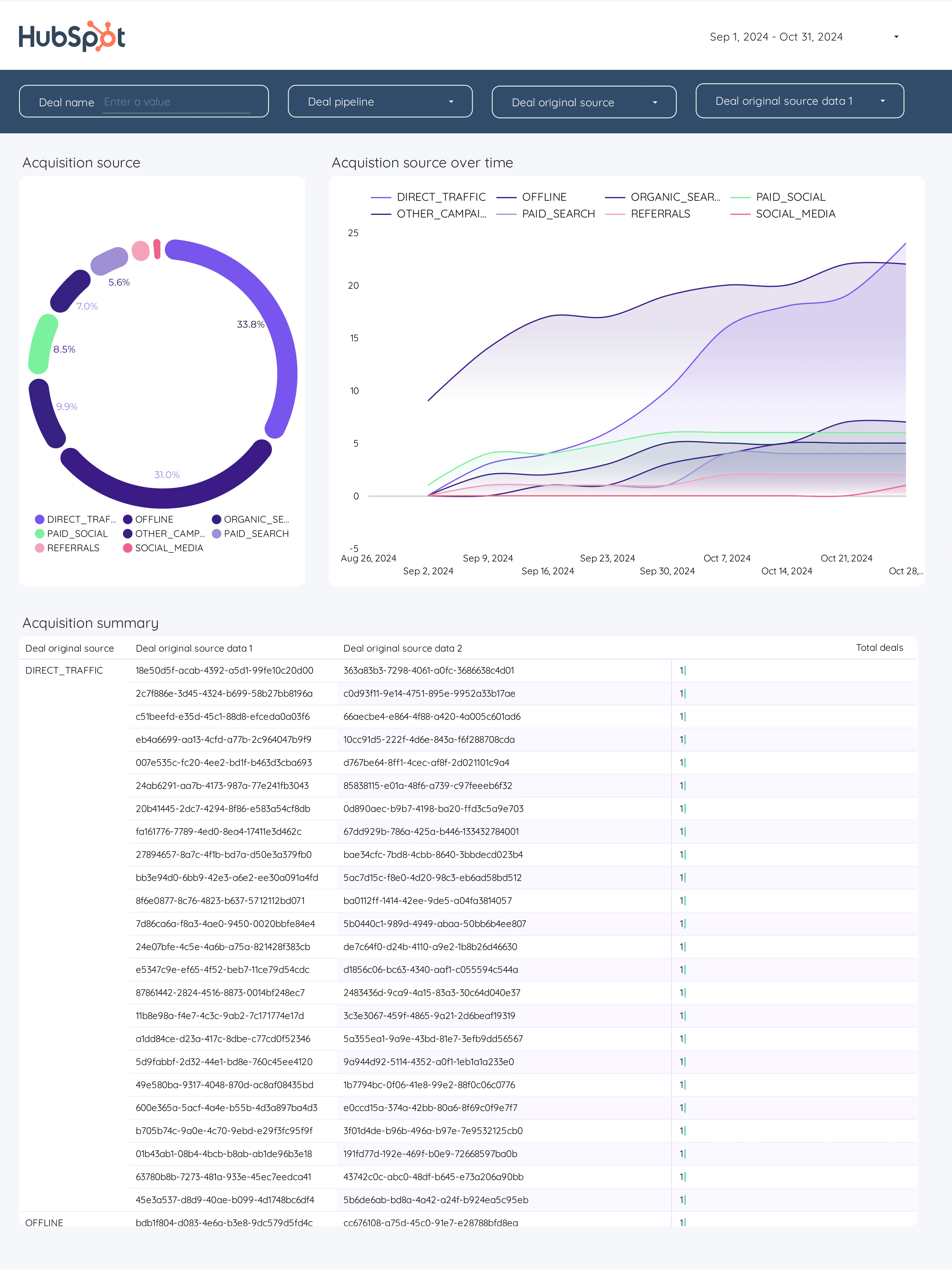

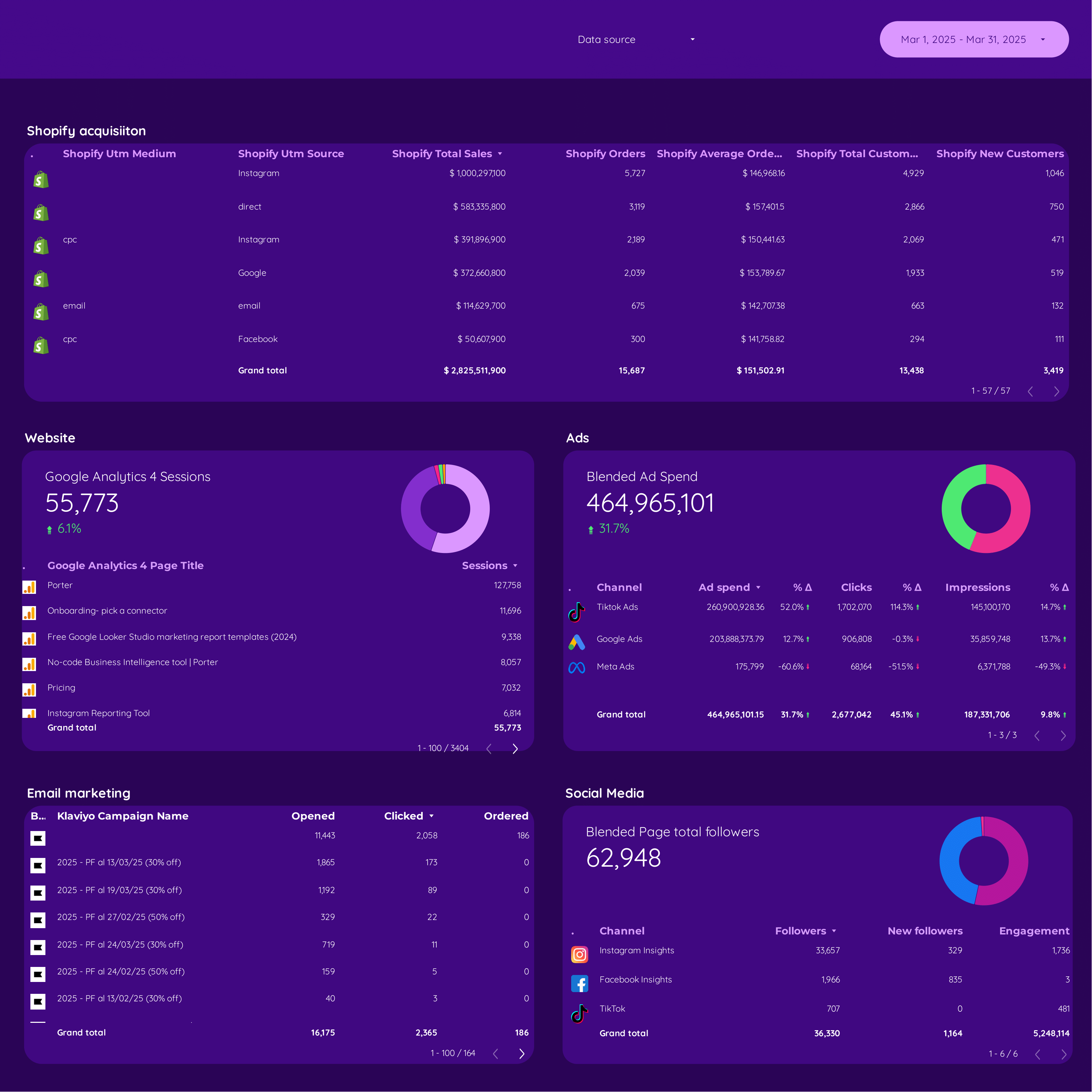

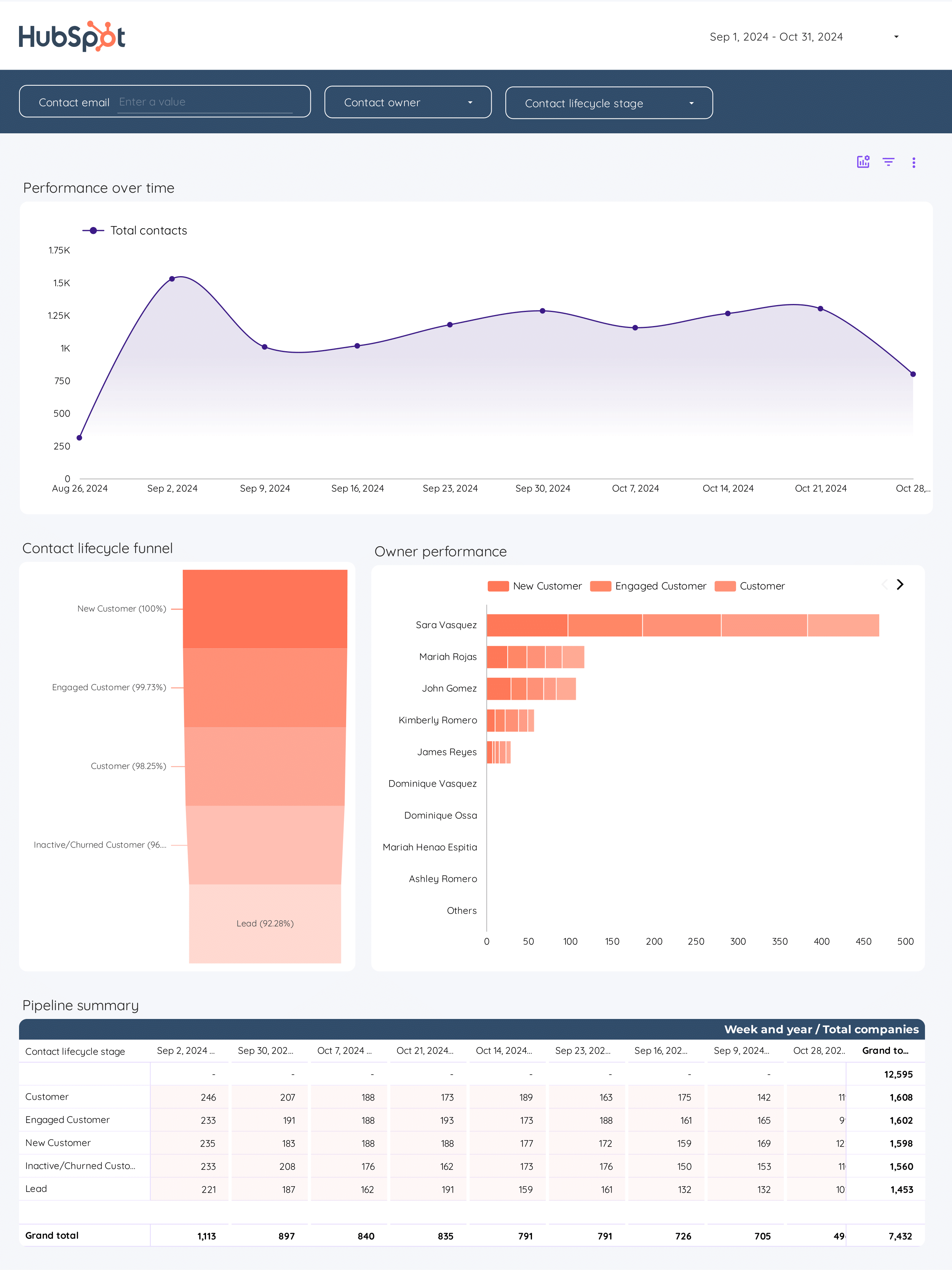

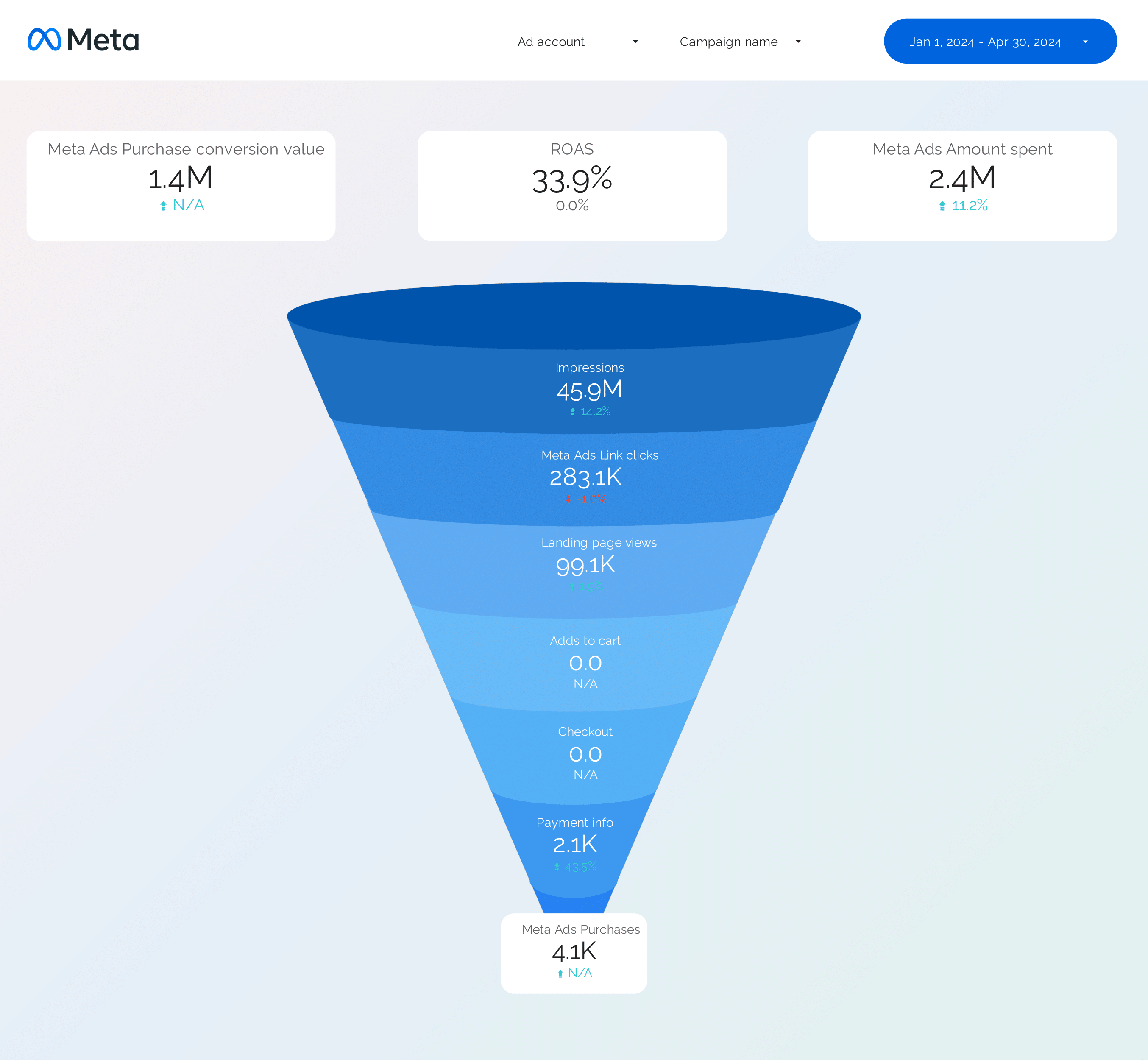

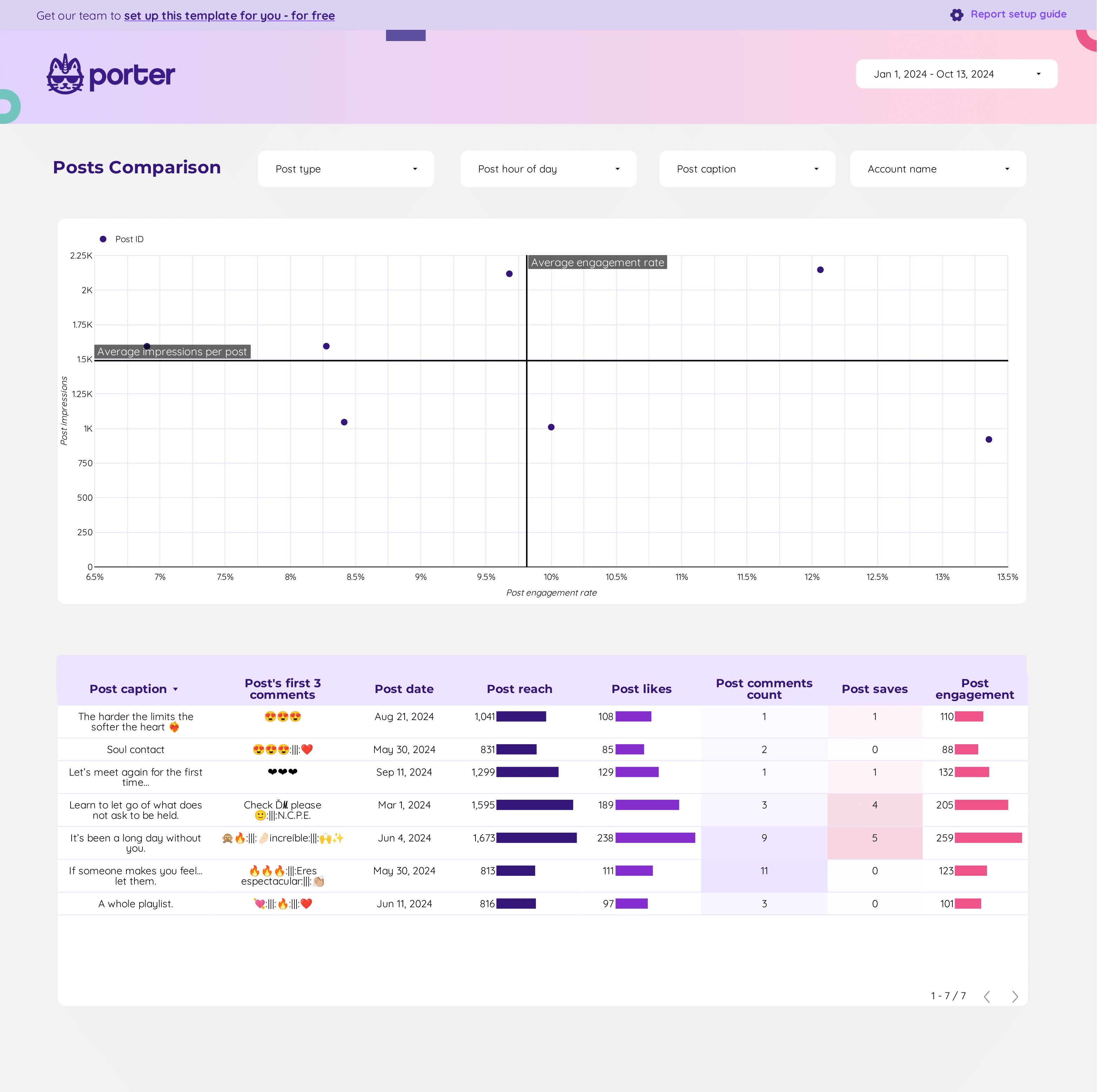

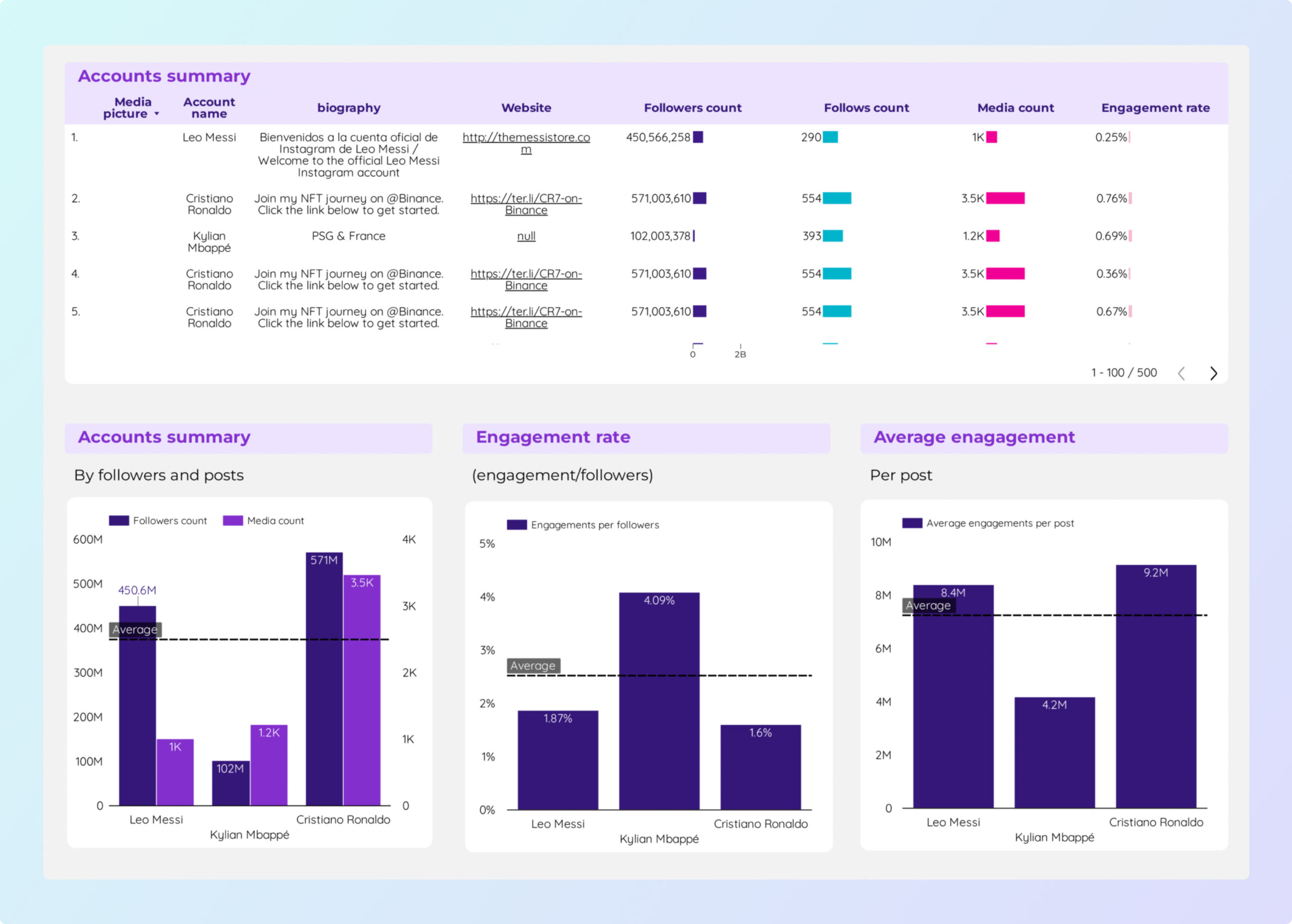

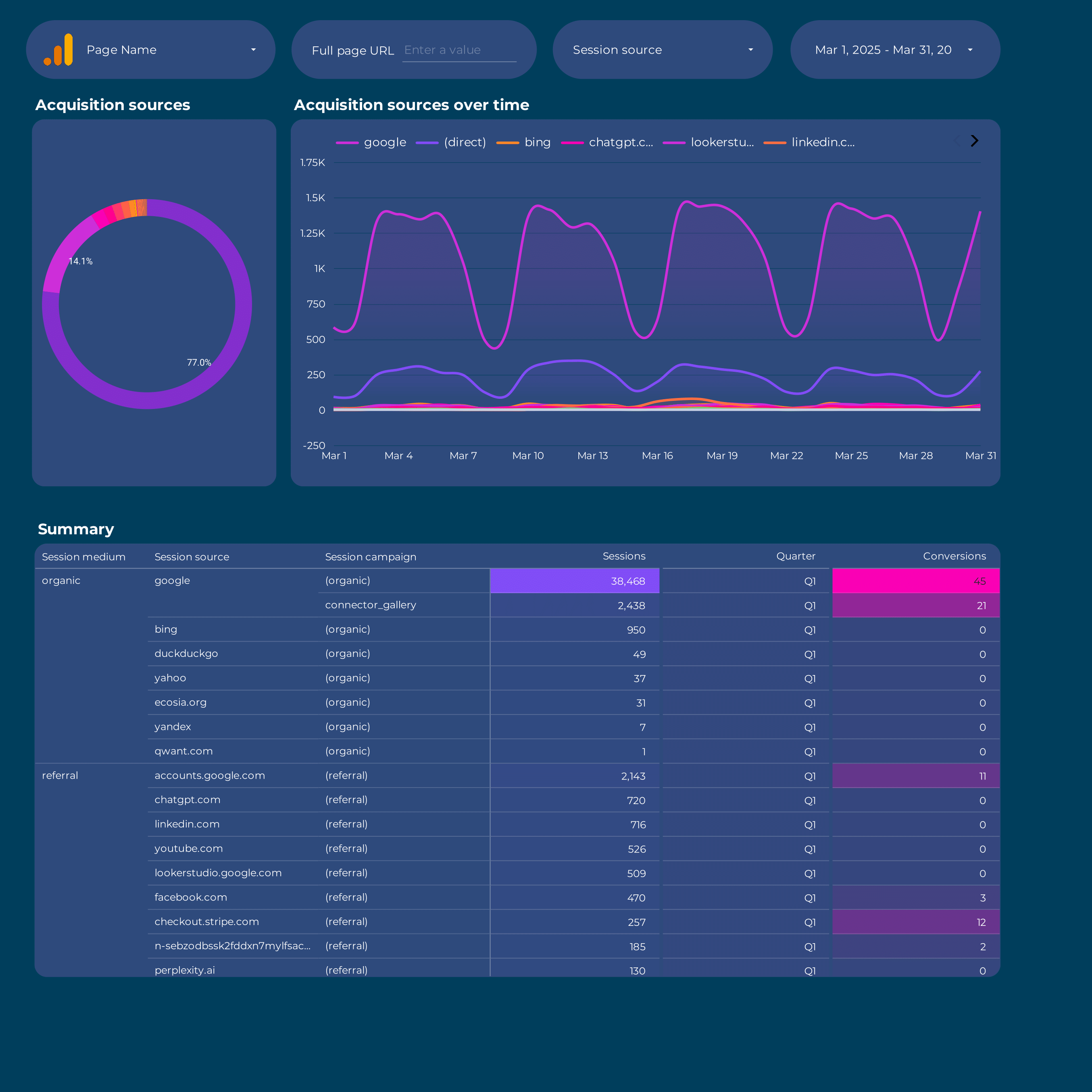

Acquisition dashboard example

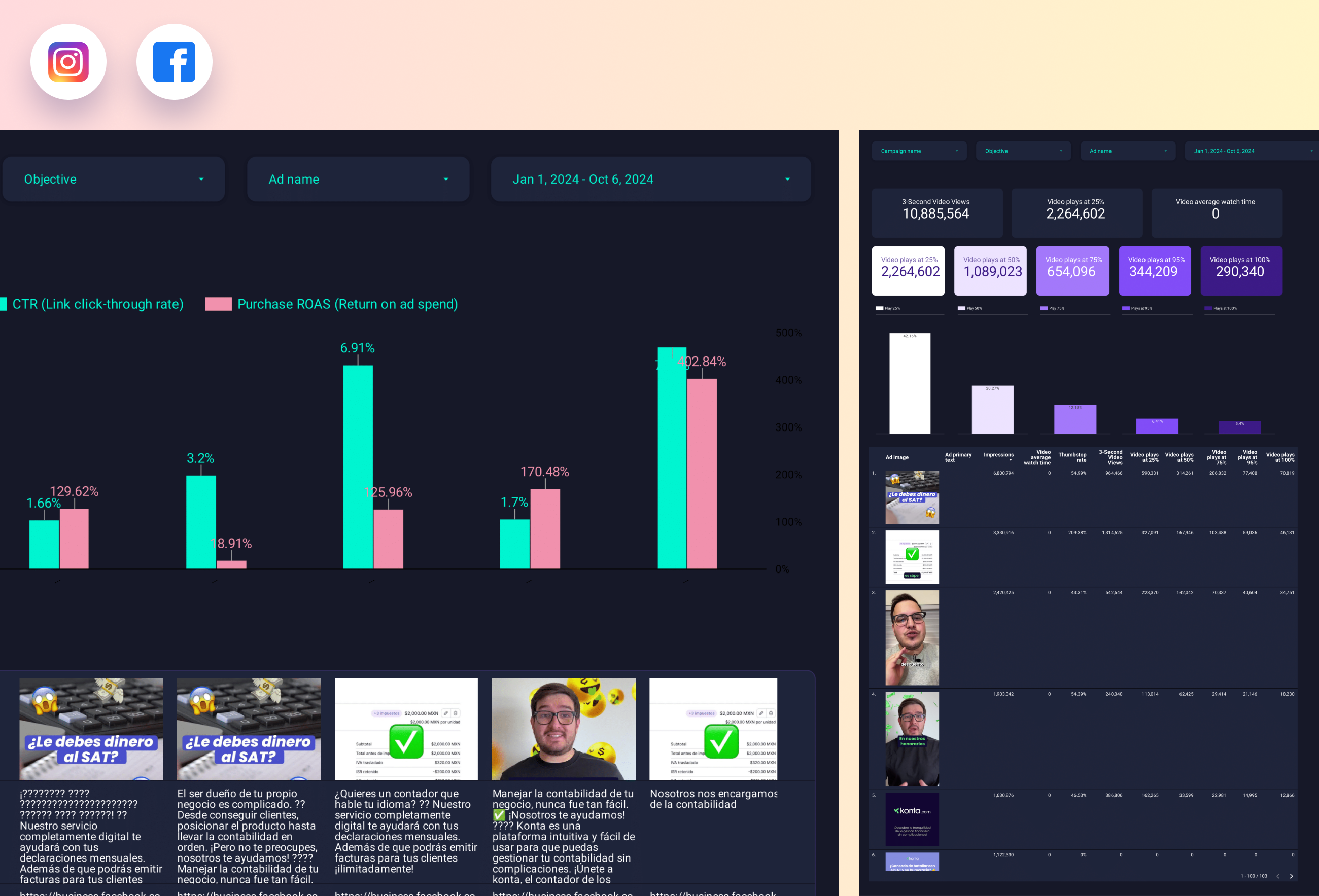

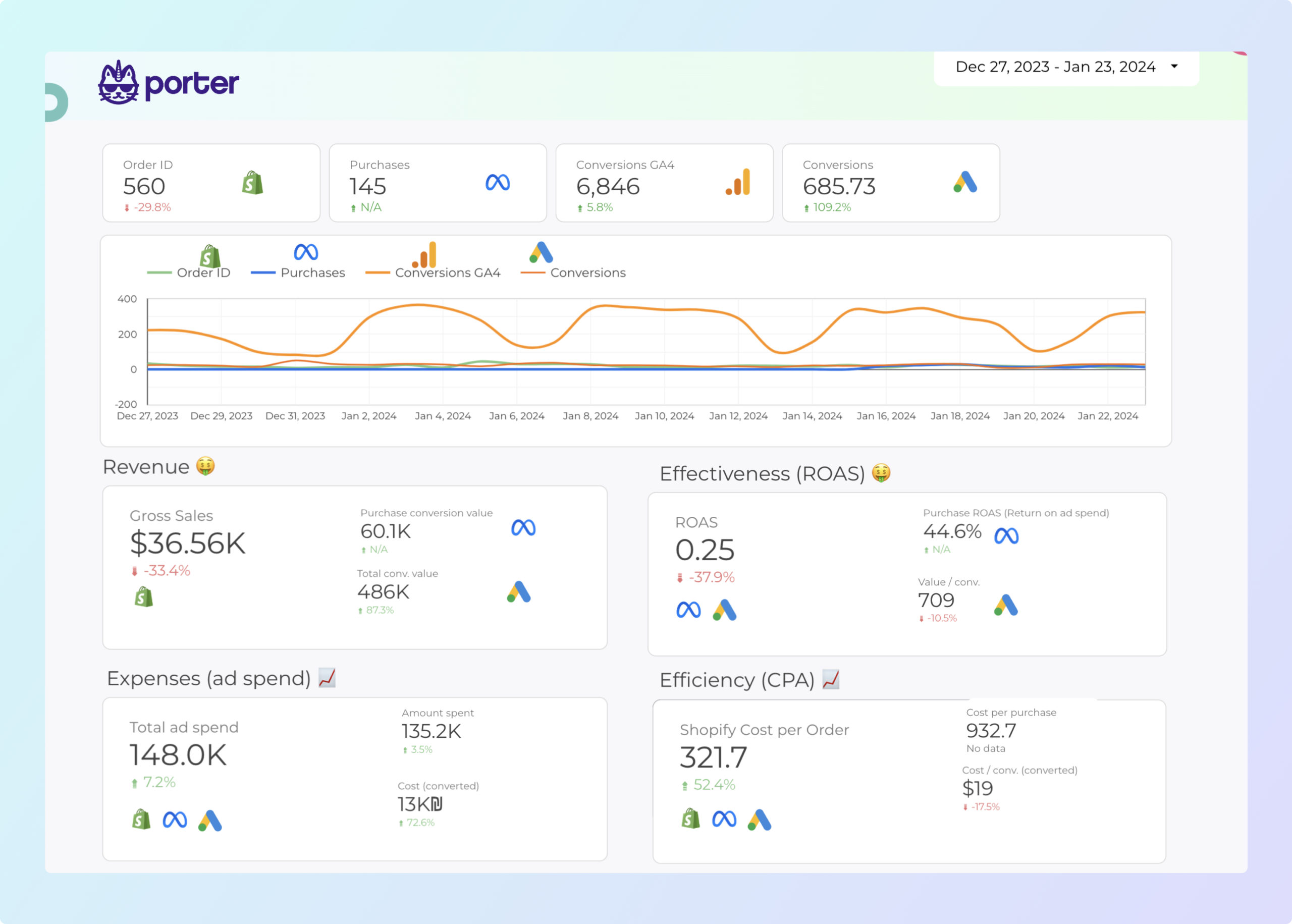

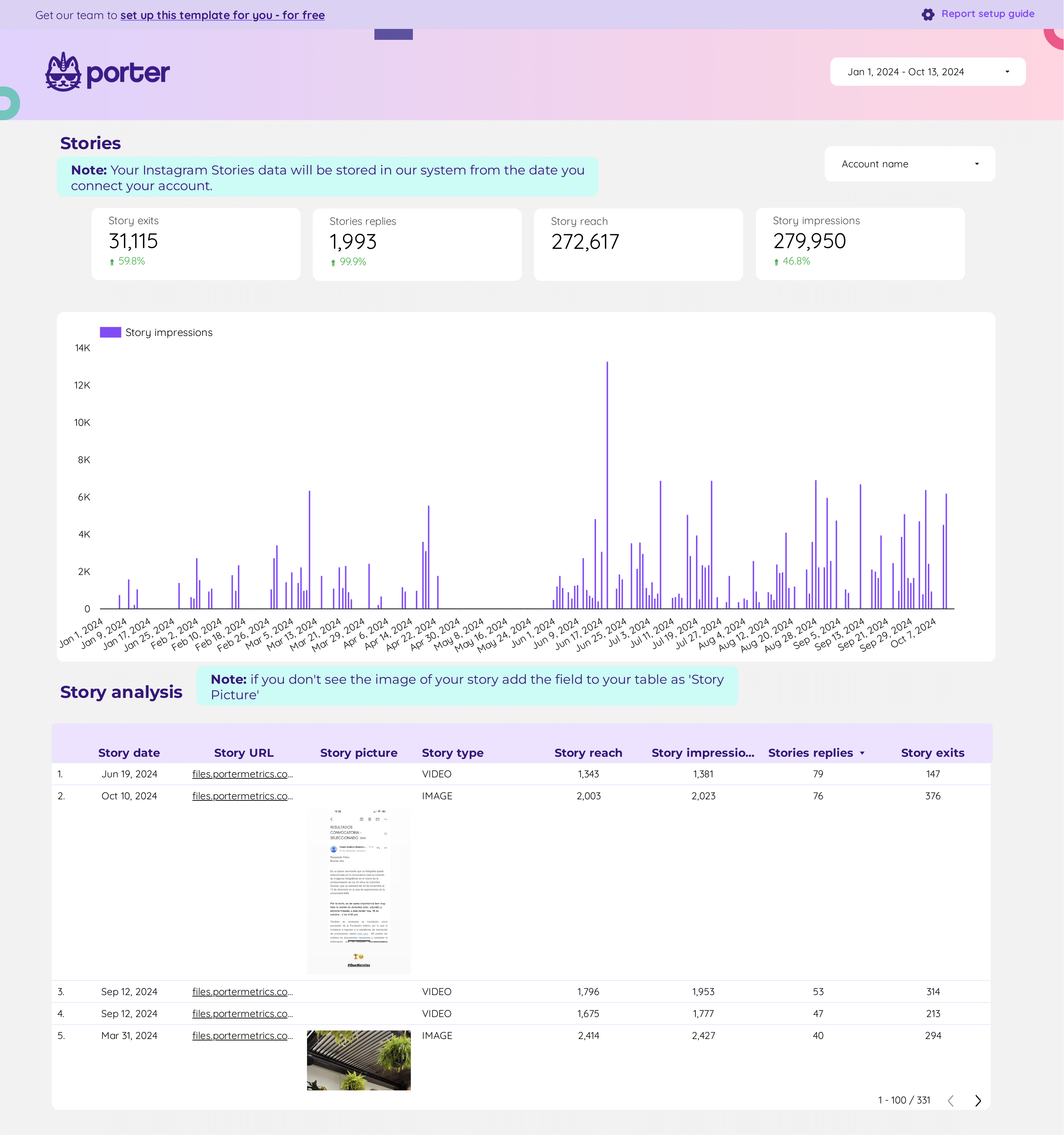

This Acquisition dashboard example helps marketing teams track key metrics like conversion rate, ROI, and CTR. Analyze dimensions such as target audience and campaign goals. Integrate data from Google Analytics 4, Copy, and PPC. Ideal for measuring performance and aligning with specific marketing objectives.